Do I Need To Prepare A 1099 For An Llc

The IRS has a form for businesses to use when they retain the services of an LLC that may trigger a 1099 filing requirement. When your business engages an LLC contractor send the company a Request for Taxpayer Identification Number and Certification Form W-9 which requires the LLC to disclose its EIN or the Social Security number of its sole owner and whether its taxed as a.

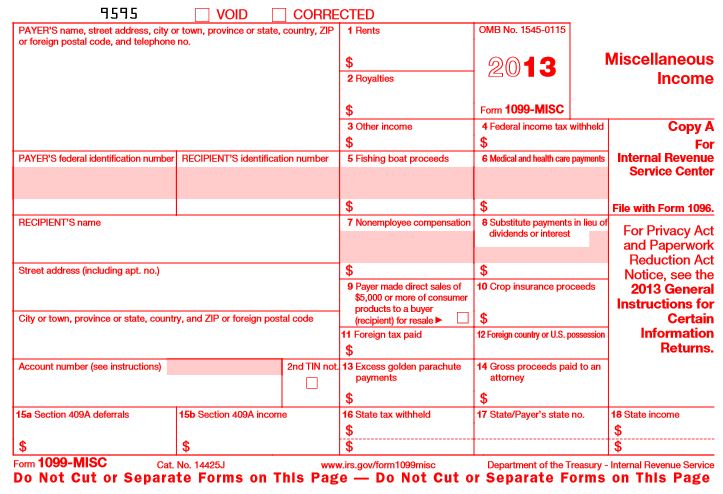

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

A W-9 form is necessary because it allows you to collect.

Do i need to prepare a 1099 for an llc. If you file 1099-MISC forms online you do not need to include a copy of the 1096 transmittal form. When your total rent payments require a 1099-MISC you will first need to request a W-9 form from the LLC that leases the property to you. Youll get a 1099 yes but thats life.

A Limited Liability Company LLC is an entity created by state statute. You do not need to send a Form 1099-MISC to. The bottom line is that a single-owner LLC taxed as a disregarded entity is the simplest way of handling things.

An LLC or limited liability corporation is the most basic business entity you can register. You can submit Form 1099-MISC for all payees online. Social Security taxable wages are capped at a maximum each year.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. Once you make this election you cannot change the LLC designation again for five years. Business owners only have to report payments for services or rent that were earned for business purposes.

In some states an LLC is expensive to form in others its cheap. An easy test is if the word Inc is in the companys name then its a corporation. You will need to register with the FIRE system before you begin filing using this system.

If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. 1 You dont need to prepare the 1099 if the vendor is incorporated. Whether the vendor is incorporated frequently seems to be the hardest determination for the business.

On the other hand for all contractors who are set up as LLCs but not filing as corporations taxed as a partnership or single-member LLC your business will need to file 1099 forms for them. If your business pays an LLC more than 600 a year for rent or services youll need to issue a 1099 Form to the LLC and file it with the Internal Revenue Service. There is a requirement for businesses and rental property owners to prepare and file Form 1099-MISC for any persons who were paid in excess of 600 and who are not W-2 employees.

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. A professional corporation except for law firms.

However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. It depends on how the LLC is taxed. Issuing a 1099 isnt difficult but its an important part of your businesss accounting and.

Do I need to file a 1099 for a Corporation LLC. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC. I personally think that an LLC is nice to have -- it gives you some more credibility than just being an individual contractor.

Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. If the LLC files as a corporation then no 1099 is required or you dont need to send 1099 to the LLC. Partnership filing requirements Limited liability companies that are subject to the partnership tax rules are not responsible for actually paying the tax on business earnings but are responsible for preparing annual partnership tax returns on IRS Form 1065.

Also as mentioned by my colleague SophiaAnnL you can always consult your accountant for the best. Payments for which a Form 1099-MISC is not required include all of the following. Yes if you have 1099 income you are considered to be self-employed and you will need to pay self-employment taxes Social Security and Medicare taxes on this income.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. See above and payments for medical or health care services see page 6 of the instructions. They dont have to report payments that were made for personal reasons.

File online with the IRS by using their Filing Information Returns Electronically FIRE system. In fact LLCs are not recognized at a national level they operate on a state-by-state basis based. A limited liability company that has elected to be taxed as a C corporation.

This is true even if you dont file a Schedule C.

How Vendor Maintenance May Need To Prepare In 2020 For The Expected Irs 1099 Nec Form Irs Accounts Payable Maintenance

How Vendor Maintenance May Need To Prepare In 2020 For The Expected Irs 1099 Nec Form Irs Accounts Payable Maintenance

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Small Business Tax

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Small Business Tax

Tax Time Checklist What Documents Do I Need Tax Time Bookkeeping Business Business Tax Deductions

Tax Time Checklist What Documents Do I Need Tax Time Bookkeeping Business Business Tax Deductions

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

How To Do Your Own Taxes And Prepare For Filing A Complete Guide Careful Cents Small Business Tax Business Tax Tax

How To Do Your Own Taxes And Prepare For Filing A Complete Guide Careful Cents Small Business Tax Business Tax Tax

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Prepare And File A 1099 For Contract And Freelance Workers

How To Prepare And File A 1099 For Contract And Freelance Workers

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Small Business Tax Preparation For Independent Contractors

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Business Tax Small Business Tips

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Business Tax Small Business Tips

Llc Business Tips Llc Business How To Start A Blog Business Tips

Llc Business Tips Llc Business How To Start A Blog Business Tips