Business License For Sole Proprietorship In Texas

For more information please refer. In a sole proprietorship a single individual engages in a business activity without necessity of formal organization.

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Business Names Sole Proprietorship Business Solutions

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Business Names Sole Proprietorship Business Solutions

If you will be operating your sole proprietorship under a name that is different from your own name then you will need to register it as an assumed business name with the county clerk in the county where your business is located.

Business license for sole proprietorship in texas. If the business is conducted under an assumed name a name other than the surname of the individual then an assumed name certificate commonly referred to as a DBA should be filed with the office of the county clerk in the county where a business premise is maintained in. Because theres no general state business license in Texas most licenses and permits in the state are issued at a local level. If you use a business name that is.

See our publication Taxable Services for more information. If you plan to use an assumed. File an Assumed Business Name.

InTexas a sole proprietor may use his or her own given name or may use a trade name. Log in to ALECS by visiting httpsalecsoccctexasgov A user account must be created before an application may be submitted. A sole proprietorship is the most common and simplest form of business structure.

Step 1 Start. Submitting an Application for a Sole Proprietorship. Handyman etc you will need to file for an Assumed Name Certificate sometimes known as a DBA or.

A general business license is not required in Texas. However it is important to determine necessary licenses permits certifications registrations or authorizations for a specific business activity at the federal state and local level. Preform a lookup by Name Tax ID Number or File Number.

A sole proprietorship exists when a single individual who owns all of the businesss assets engages in business activity without the. Sell tangible personal property in Texas. Lease or rent tangible personal property in Texas.

Texas does not require a general business license by a sole proprietor but depending on the nature of the business activity you may need to acquire a business license to work in a compliant manner. Which state-level license your business will be needing depends upon the services or goods you offer as a. A business must obtain a Texas Sales Use Tax permit from the Texas State Comptroller Office if they are engaged in business in Texas and they are selling tangible personal property leasing personal property or selling a taxable service in Texas.

There is no fee for the permit. Log in or Create a New Account in ALECS. When preforming your lookup by name be sure to include as many keywords as.

Search for a business entity Corporation LLC Limited Partnership in Texas by going to the Secretary of States Website. If you are a sole proprietorship operating under an assumed name in Texas you must register your name with the office of the county clerk in the county of your businesss principal location. If youre a Sole Proprietor you need a DBA to register your business name DBA is an abbreviation for doing business as Well prepare and file all required documents to start your DBA Get started Starting at 99 state filing fees.

Sell taxable services in Texas. Registration notifies the public as to the name under which you do business. If you are a sole proprietorship or general partnership in Texas and doing business under your full first and last name John Smith for example there is no filing but if the business will operate under a fictitious business name or DBA Doing Business As like John Smiths Handyman Service Mr.

Texas Secretary of State. To establish a sole proprietorship in Texas heres everything you need to know. There isnt a requirement in Texas for sole proprietors to acquire a general business license but depending on the nature of your business you may need other licenses andor permits to operate in a compliant fashion.

You must obtain a Texas sales and use tax permit if you are an individual partnership corporation or other legal entity engaged in business in Texas and you. Choose a Business Name.

Http Occc Texas Gov Sites Default Files Uploads Licensing How To Submit Application Mvsf Alecs Pdf

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

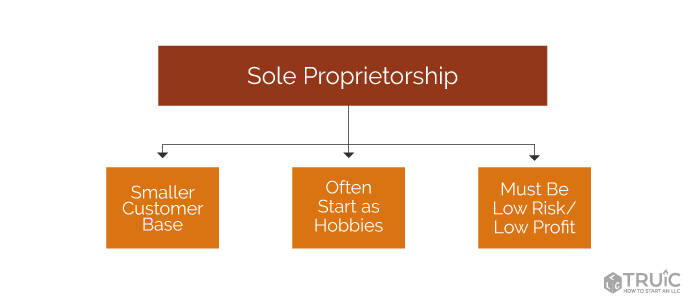

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

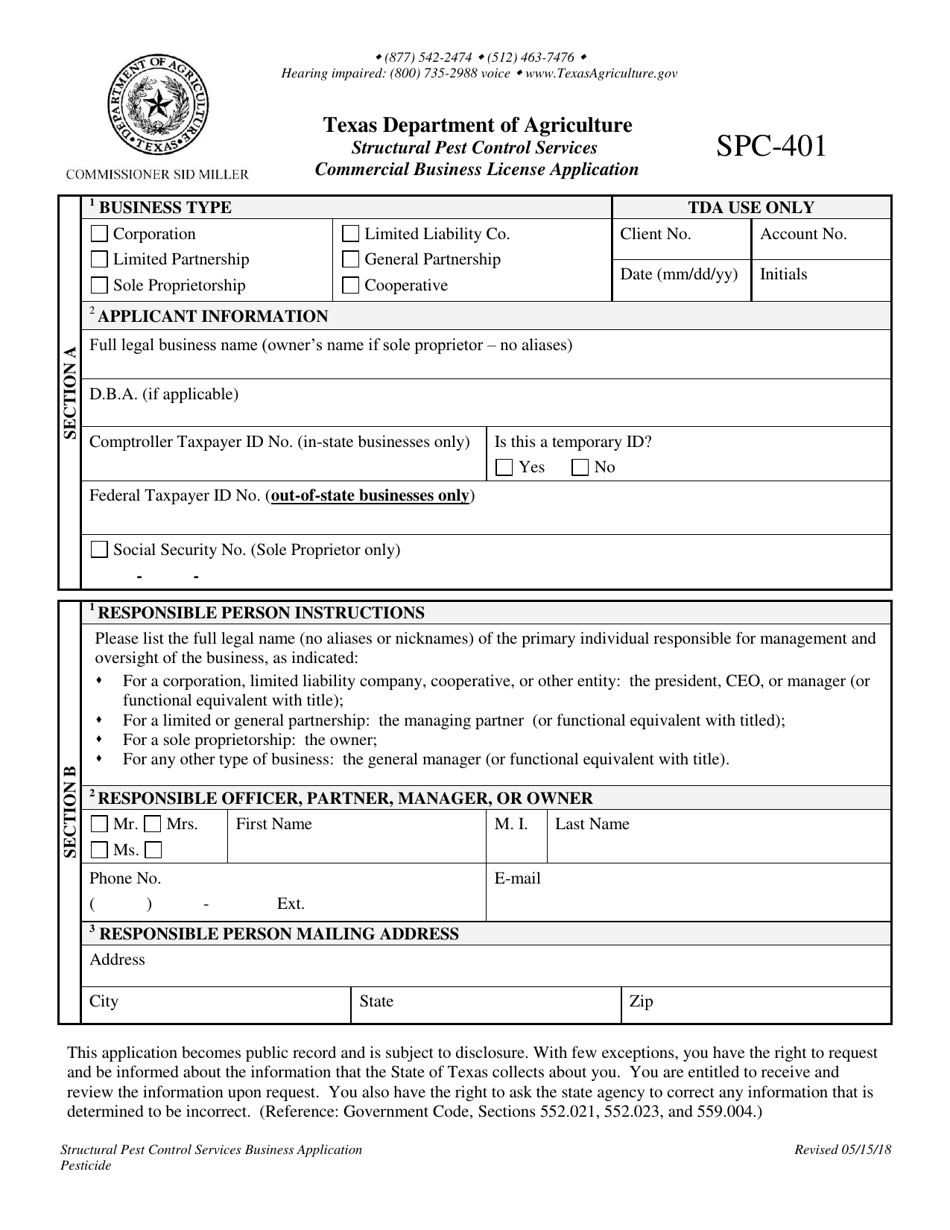

Form Spc 401 Download Printable Pdf Or Fill Online Structural Pest Control Services Commercial Business License Application Texas Templateroller

Form Spc 401 Download Printable Pdf Or Fill Online Structural Pest Control Services Commercial Business License Application Texas Templateroller

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

Http Occc Texas Gov Sites Default Files Uploads Licensing How To Submit Application Mvsf Alecs Pdf

Should I Stay A Sole Proprietorship Kapitus

Should I Stay A Sole Proprietorship Kapitus

Can I Operate A Sole Proprietorship Without A Dba In Texas Legalzoom Com

Can I Operate A Sole Proprietorship Without A Dba In Texas Legalzoom Com

Owning A Sole Proprietorship In The State Of Texas

Owning A Sole Proprietorship In The State Of Texas

How To Start A Sole Proprietorship 14 Steps With Pictures

How To Start A Sole Proprietorship 14 Steps With Pictures

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Thinking About Starting A Sole Proprietorship Learn More Here

Thinking About Starting A Sole Proprietorship Learn More Here