Do Pc Need 1099

Report on Form 1099-MISC only when payments are made in the course of your trade or business. However a few exceptions exist that require.

Understanding Your Tax Forms 2016 Form 1099 A Acquisition Or Abandonment Of Secured Property Tax Forms Rental Agreement Templates Resignation Letter Format

Understanding Your Tax Forms 2016 Form 1099 A Acquisition Or Abandonment Of Secured Property Tax Forms Rental Agreement Templates Resignation Letter Format

If you decide you need to 1099-MISC your CPA or building contractor you can send them a W-9 form that asks them to provide their tax number to you.

Do pc need 1099. The IRS only requires 1099-MISC forms for services provided for your business not for merchandise or goods. You do not need to send a Form 1099-MISC to. Any amount of money paid to attorneys organized as PLLC or any other corporate structure must be reported to the IRS on a 1099-MISC in box 14.

You do not need to issue 1099s for personal expenses. This is the equivalent of a W-2 for a person thats not an employee. You must also file a 1099-MISC if you paid someone a minimum of 10 in royalties.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. You will need to provide a 1099 to any vendor who is a. A professional corporation except for law firms.

The exception to this rule is with paying attorneys. A 1099 is also not required for payments to corporations. They can either give you their SSN or.

However nonprofit organizations are considered to be engaged in a trade or business and are subject to these reporting requirements. You do not need to send one for non-business reasons including personal services. There is a separate reporting system in place where the credit card processor reports all payments made on a 1099-K.

Below that threshold you do not need to report the payment. A limited liability company that has elected to be taxed as a C corporation. If they check any box other than b then you send them a 1099 form.

If you are paid as a contractor by one or more of your clients you will receive the 1099-NEC but you do not need to send it to the IRS. Personal payments are not reportable. However if it was to remodel your office then you will need to send one out.

A 1099 is only required for payments that are not paid by credit card. For example payment to your doctor. In addition use Form 1099-MISC to report that you made direct sales of at least 5000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. You must send and file a 1099-MISC for certain types of payments if you paid 600 or more during the year. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. The designation of PC stands for Professional Corporation and generally firms that have that designation as part of their name are in fact registered as corporations. You only need to give 1099s if you are using the expense on your business or farm.

See above and payments for medical or health care services see page 6 of the instructions. In this case there is no need to send out a 1099-MISC form because the work was for personal purposes. For example if you used a freelancer to design your website you should issue the freelance designer a 1099-MISC form for their service.

You are engaged in a trade or business if you operate for gain or profit. But again the requirement is that you have them fill out the W-9 to have them actually indicate their tax status. You dont need to issue a 1099-MISC if the check is made out to another LLC or other type of corporation.

So do not issue a 1099 for credit card payments since this will result in double reporting. Specifically you must file a 1099 for each person to whom you paid for any services attorney fees medical and health care payments or rents. You must file Form 1099-MISC for each person to whom you paid income made certain payments or awarded prizes.

A company may need to file a 1099-MISC for funds it pays a PLLC if it meets one of the IRS requirements to receive a form.

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Https Ift Tt 2khnwcf Finished My Station Still Need To Tidy Up A Few Things Computer Desk Setup Computer Setup Best Gaming Setup

Https Ift Tt 2khnwcf Finished My Station Still Need To Tidy Up A Few Things Computer Desk Setup Computer Setup Best Gaming Setup

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Pin By Sideus Technologies On The Computer To Own Computer Case Custom Pc Best Computer

Pin By Sideus Technologies On The Computer To Own Computer Case Custom Pc Best Computer

Turbotax Business 2017 Fed Efile Pc Download Read More Reviews Of The Product By Visiting The Link On The Image This Is An Turbotax Tax Software Efile

Turbotax Business 2017 Fed Efile Pc Download Read More Reviews Of The Product By Visiting The Link On The Image This Is An Turbotax Tax Software Efile

Will And Trust Form Sample Will And Trust Form 15 Free Documents In Pdf Obamacare Facts Attendance Sheet Template Job Application Form

Will And Trust Form Sample Will And Trust Form 15 Free Documents In Pdf Obamacare Facts Attendance Sheet Template Job Application Form

Small Business 1099 Misc Reporting Requirements Dalby Wendland Co P C

Small Business 1099 Misc Reporting Requirements Dalby Wendland Co P C

Redoing My Setup Need Advice On Speaker Placement I Need To Get Them Off The Desk But I Can T Mount Them On The Wal Computer Setup Gaming Computer Setup Setup

Redoing My Setup Need Advice On Speaker Placement I Need To Get Them Off The Desk But I Can T Mount Them On The Wal Computer Setup Gaming Computer Setup Setup

Are You Wondering You You Need To Issue A 1099 Misc To This Article Will Clear Up Any Confusion When It Comes Diy Taxes Small Business Finance Small Business

Are You Wondering You You Need To Issue A 1099 Misc To This Article Will Clear Up Any Confusion When It Comes Diy Taxes Small Business Finance Small Business

Turbotax Business Partnerships Corporations Llcs Trusts Estates Pc Download Software Turbotax Small Business Software Computer Security

Turbotax Business Partnerships Corporations Llcs Trusts Estates Pc Download Software Turbotax Small Business Software Computer Security

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

1099 Misc 5 Part 2020 Tax Forms Kit With Software Download 15 Count Tax Forms Small Business Accounting Software Tax Software

1099 Misc 5 Part 2020 Tax Forms Kit With Software Download 15 Count Tax Forms Small Business Accounting Software Tax Software

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Isetups On Instagram Today S Isetups What Do You Thi Isetups On Instagram Today S Isetups Gaming Room Setup Game Room Design Computer Gaming Room

Isetups On Instagram Today S Isetups What Do You Thi Isetups On Instagram Today S Isetups Gaming Room Setup Game Room Design Computer Gaming Room

1099 Tax Document Income Statement Income Tax

1099 Tax Document Income Statement Income Tax

The Top 20 Workspaces Of 2019 Ultralinx Desk Setup Home Office Setup Gaming Room Setup

The Top 20 Workspaces Of 2019 Ultralinx Desk Setup Home Office Setup Gaming Room Setup

Turbotax Business 2018 Tax Software Pc Download Tax Software Turbotax Software

Turbotax Business 2018 Tax Software Pc Download Tax Software Turbotax Software

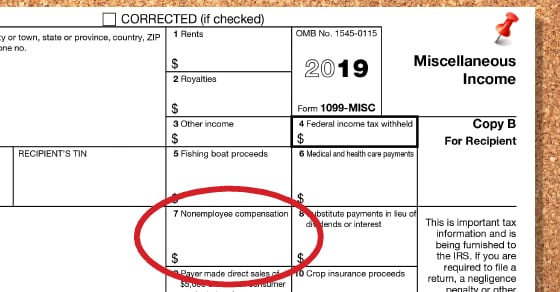

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition