Do You Send 1099 To Utility Companies

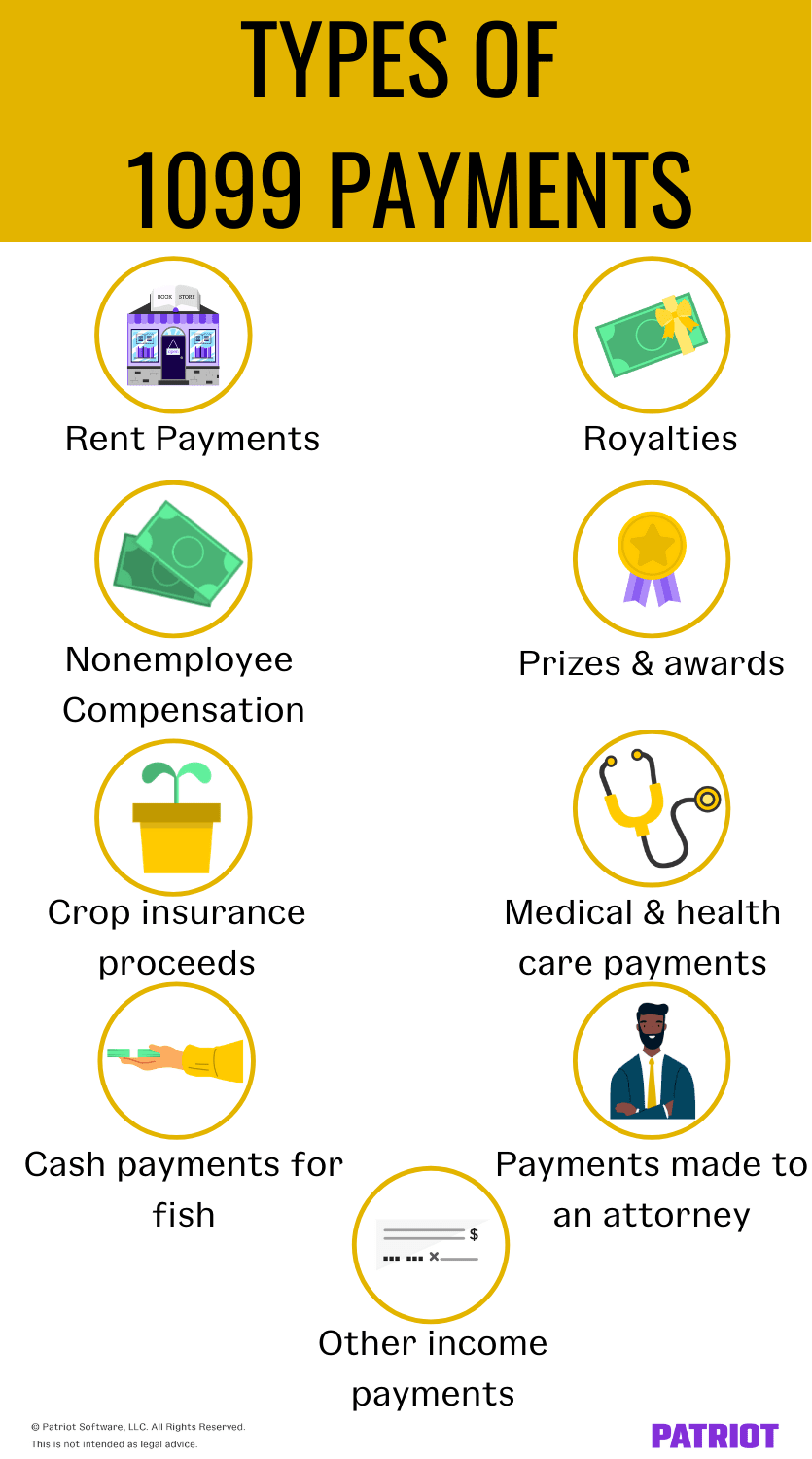

You must send and file a 1099-MISC for certain types of payments if you paid 600 or more during the year. 6 rows Items that do NOT need to be reported on Form 1099-MISC.

Form 1099 Nec For Nonemployee Compensation H R Block

16041-3 c exempts payments for freight services from the general requirement for payors to issue Form 1099 to independent contractors and others with which they do business.

Do you send 1099 to utility companies. For example if you paid Company A. The Substitute Form W-9 is available on the. Vendors who operate as C- or S-Corporations do not require a 1099.

Follow this 1099 Decision Tree to help you decide who you need to supply a form to. You dont have to report payments to pharmacies for prescription drugs. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

However the buyer has reported the sale to you and the IRS on Form 1099S. It would be highly unusual if not unheard of for an insurance agency to function as anything other than a corporation or a limited liability taxed as a corporation. Anytime that you pay someone more than 600 during the year for services which they have performed you should have that person or company fill out a W-9 form for you.

How to File 1099s. This includes payments to medical health care insurance companies. Favorite Answer You do not have to send 1099s to corporations.

You should obtain a completed Substitute Form W-9 when initiating any transaction with a new vendor that could be reportable on a 1099-MISC. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. If you paid your vendor through PayPal or a Credit Card the merchant will issue them a 1099K and you wont have to.

Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. 1099 Forms and Insurance Agencies. 1 To a Business First the payments need to be made in a business so you dont have to prepare a 1099-MISC for the guy who cuts your home lawn.

Thus trucking companies need not issue Form 1099s to owner-operators that are under lease for freight hauling services. The new requirement to send 1099s to virtually everyone was revoked last month so you need NOT send 1099s to the utility company. Regarding the issuance of 1099s the current rules are as follows.

You must complete and submit Form 1099-MISC to all applicable businesses by January 31 of the following year. If this happens to you youll need to write back to the IRS and explain the payment was for a. If you are in business whether self-employed or running a company you must send a 1099 form with copies to the IRS to anyone that you pay money to unless the payments meet one or more of the.

This also applies if your landlord is the one who passes along monthly utility bills to you that arrive from utility providers to allow you to pay directly. In that statement alone there are some keys to what needs to be reported including. While utility bills technically count as payment when theyre rolled into your rent they dont belong on a 1099-MISC if you pay utility companies directly.

The same rule applies to farmers that make payments in connection with the trucking or. Below that threshold you do not need to report the payment. The primary purpose of the 1099-MISC is to report income individuals independent contractors etc receive to.

On that form they are required to check whether they are taxed as a sole proprietor partnershipor corporation. You do not have to send a 1099-MISC form to corporations nor to limited liability companies which have made an election to be treated as corporations for income tax purposes. Form 1099-MISC is used to report payments made to vendors that provide services to a business.

Anyone who checks any box other than corporation needs to be sent a 1099-MISCform if you paid them 600 or. Apr 28 2011 0511 PM. If you paid your vendor directly through your bank account check debit card ACH you are responsible for sending them a 1099.

You NEVER send Form 1099-MISC to a municipality. If your business this includes self-employed individuals LLCsPartnerships and Corporations pays 600 or more a year for services rent or royalties to any individual Partnership or LLC not taxed as a corporation you are required to issue Form 1099-Misc reporting the total dollar amount paid to them during the year. Who are considered Vendors or Sub-Contractors.

Is any foreign entity eg foreign individual foreign company etc. The IRS will often send letters to the taxpayer in this situation and attempt to add the sales price to your taxable income. Business structures besides corporations general partnerships limited partnerships limited liability companies and sole proprietorships require Form 1099 issuance and.

Bank Money Deposit Form 2 Advantages Of Bank Money Deposit Form And How You Can Make Full Us Bank Of America Banking App Power Of Attorney Form

How To Fill Out And Print 1099 Nec Forms

Training Dynamo S Survival Guide For Microsoft Dynamics Gp And The New 1099 Nec Form The Official Blog For Training Dynamo Llc

Ambit Energy Statement Ambit Energy Energy Bill Template

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

How To File Form 1099 Nec For Contractors You Employ Vacationlord

Encino Energy Tax Forms Create Questions For Royalty Owners Farm And Dairy

Training Dynamo S Survival Guide For Microsoft Dynamics Gp And The New 1099 Nec Form The Official Blog For Training Dynamo Llc

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Form 1099 Overview And Faq Buildium Help Center

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Office Depot 1099 Nec Formssoftware 50pk Office Depot

1099 Payments How To Report Payments To 1099 Vendors

26 Best Form 1099 A Photo Best Form Template Example Within 1099 Template 2016 Free

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

Form 1099 C Cancellation Of Debt Definition

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms