Sba Disaster Loan Approval Process

For loans approved prior to the week of April 6 2021 see. The SBA will use this information in comparison to your historical results to develop their loan amount recommendation.

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Treasury Apply directly to SBAs Disaster Assistance Program at.

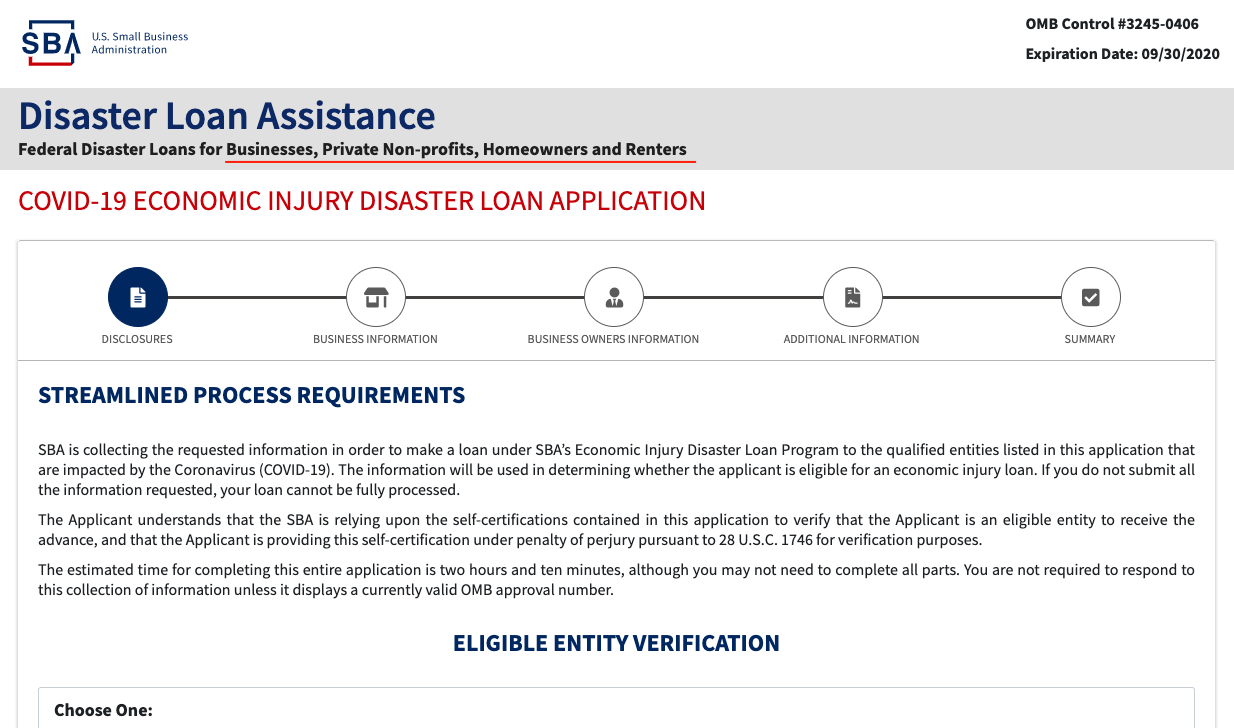

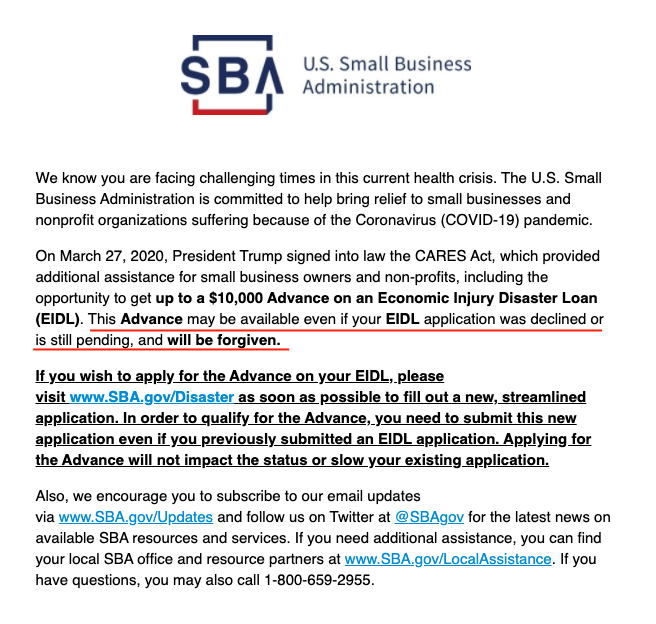

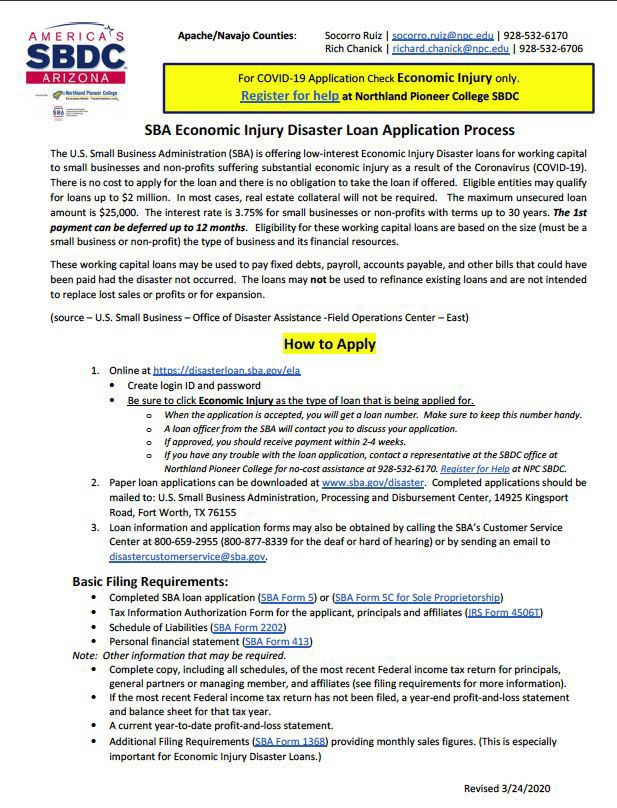

Sba disaster loan approval process. As part of the CARES Coronavirus Aid Relief and Economic Security Act the Federal government gave the EIDL. SBA COVID-19 Disaster Loan Checklist. Httpwwwsbagovdisaster August 2017 Required Documentation The following documents are required to process your application and reach a loan decision.

Below is the list of the documents prospect applicants should assemble for upload into the SBA Economic Injury Disaster Loan EIDL site. Verify property review credit and process loan for final decision. The SBA anticipates the money will be distributed 3 days after that three-week loan officer review and approval period.

Complete sign and date IRS Form 4506-T with your application giving permission for the IRS to provide SBA your tax return information. The Economic Injury Disaster Loan program through the SBA is a long-standing program intended to help businesses hurt by tornados or wildfires. Once the loan has been approved the SBA currently estimates that it will take approximately five days to receive the money.

How long does SBA disaster loan approval take. 14 hours agoSBAs COVID-19 Economic Injury Disaster Loan EIDL Advance. Much of the waiting time spent during the SBA loan approval process possibly up to 30 days youll spend gathering documentation for the lender to process.

The SBA makes these disaster loans a priority so you can expect to hear back on their decision within a few weeks. The SBA states that the first and second step takes an average of four weeks. Apply for the loan.

Luckily the SBA conveniently outlines this for you in this checklist. The SBA is offering low-interest federal disaster loans for working capital to. Apply online for an SBA disaster assistance loan.

Funds come directly from the US. This loan applies to all businesses based in any US. The SBA suggests you forecast a minimum of 3 months but recommend 6 to 9 months if possible.

Close loan and disburse funds. Businesses of all sizes located in declared disaster areas private nonprofit organizations homeowners and renters affected by declared disaster including civil unrest and natural disasters such as hurricanes flooding wildfires etc. Application Property Verification Loan Processing Decision and Loan Closing Disbursement of Funds.

For loans approved starting the week of April 6 2021. With this in mind spend a little extra energy making sure every detail is correct before you click submit. Your Loan Officer and Case Manager will assist you to ensure that you submit the proper documentation.

Congress in the CARES Act in March 2020 told the SBA to given an immediate 10000 grant to everyone who applied for an emergency Disaster Loan due to the pandemic. After youve applied it can be another few weeks before you receive a decision. One thing to note is that the most commonly cited reason for delays in the process is an incomplete application.

SBA Disaster Loan Approval Time Receiving an SBA disaster loan is a three-step process. After the national disaster was declared in March 2020 funds became available to help small businesses impacted by the pandemic. However historically disaster loans have taken approximately three weeks from time of application until completion of loan officer assessment submission of any additionally required documentation and final loan approval.

SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. DisasterLoansbagov There is no cost to apply There is no obligation to take the loan if offered The maximum unsecured loan amount is 25000 Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster but the loans cannot be. Step 3 takes around five days for borrowers to receive funds.

The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters. The SBA is estimating it will take between eight and 21 days to process the loan application depending on the complexity of the business and the number of applications received. SBA will send an inspector to estimate the cost of damage once your application is completed and submitted.

Time varies based on the ability to have each part of the process completed in a timely. FAQ Regarding COVID-19 EIDL. 24-months of economic injury with a maximum loan amount of 500000.

How long will it take to get the money. The SBA recommends prospective applicants assemble their documents required for the loan application allowing them to more quickly move through the loan review and approval process. Approval decision and disbursement of loan funds is dependent on receipt of your documentation.

This is your forecast of what your business will look like as affected by the impacts of the disaster. To meet financial obligations and operating expenses that could have been met had the disaster not occurred. SBA said nah well give them 1k per employee with a 10k CAP The CARES Act said give them loans worth six months of expenses up to 2MM cap.

State territory or the District of Columbia.

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Heres Why You Should Attend Sba Disaster Relief Sba Disaster Relief Disaster Relief Financial Help Disasters

Heres Why You Should Attend Sba Disaster Relief Sba Disaster Relief Disaster Relief Financial Help Disasters

Nglcc Sba Disaster Relief Webinar Nglcc S Takeaways Nglcc Org

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Types Of Sba Loans 6 Sba Loan Programs In Detail Sba Loans Loan Type

Types Of Sba Loans 6 Sba Loan Programs In Detail Sba Loans Loan Type

An Overview Of The 6 Primary Types Of Sba Loans 7a Cdc X2f 504 Caplines Export Loan Microloa Sba Loans Small Business Administration Small Business Loans

An Overview Of The 6 Primary Types Of Sba Loans 7a Cdc X2f 504 Caplines Export Loan Microloa Sba Loans Small Business Administration Small Business Loans

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Faqs As Of 3 19 20 On Sba Economic Injury Disaster Loans Seedcopa

Faqs As Of 3 19 20 On Sba Economic Injury Disaster Loans Seedcopa

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Eidl Loan Approval Processing Time What To Expect

Eidl Loan Approval Processing Time What To Expect

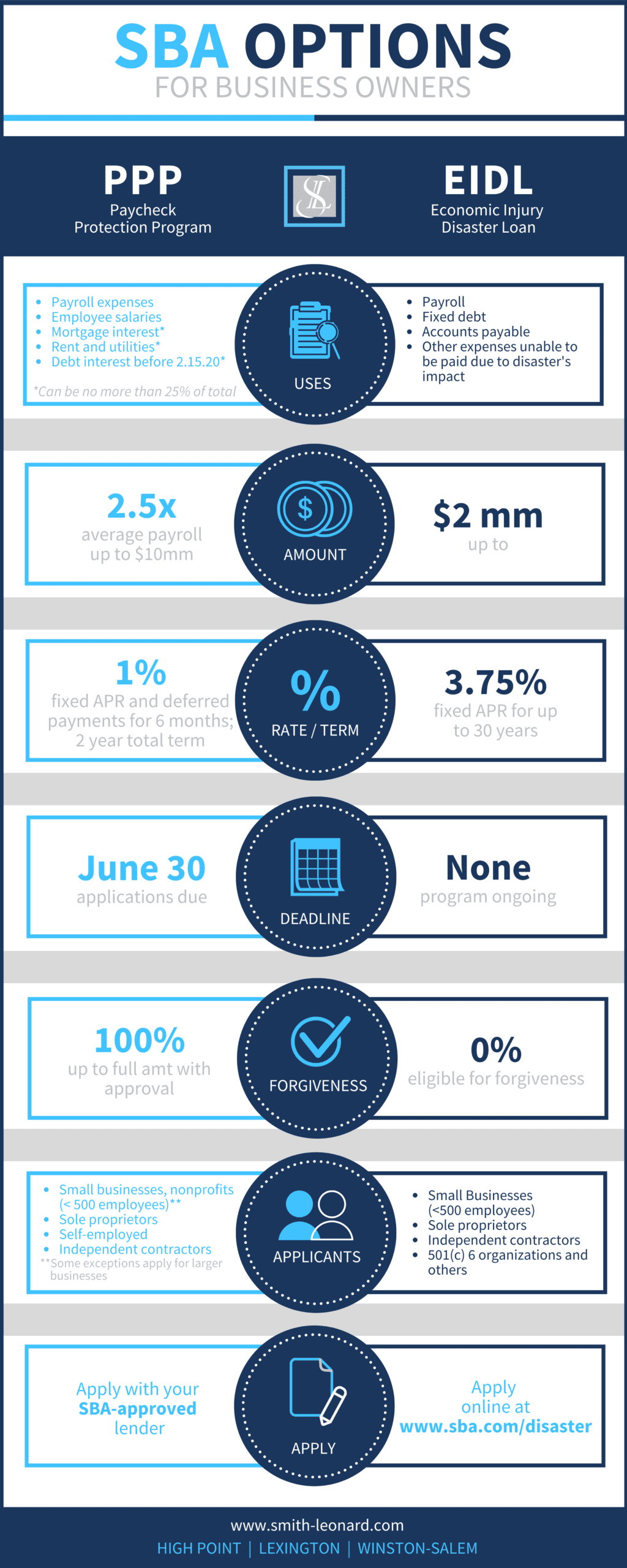

Sba Loan Information Smith Leonard

Sba Loan Information Smith Leonard

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

The Mortgage Process Explained In 7 Steps In 2021 Mortgage Process Mortgage Brokers Mortgage

The Mortgage Process Explained In 7 Steps In 2021 Mortgage Process Mortgage Brokers Mortgage

Understanding The Sba Economic Injury Disaster Loan Application Process Startup Junkie

Understanding The Sba Economic Injury Disaster Loan Application Process Startup Junkie

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business