Cra Business Gst Return Form

For GSTHST TELEFILE call 1-800-959-2038 some restrictions apply. For GSTHST NETFILE go to wwwcragccagsthst-netfile.

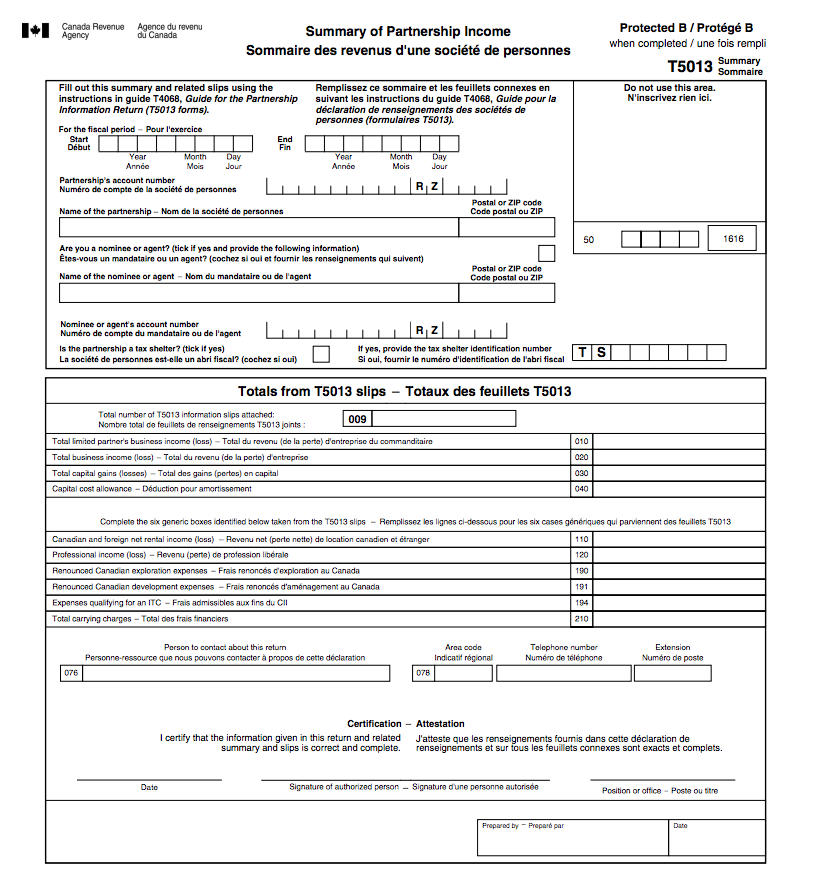

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

If you didnt file electronically the CRA will mail you.

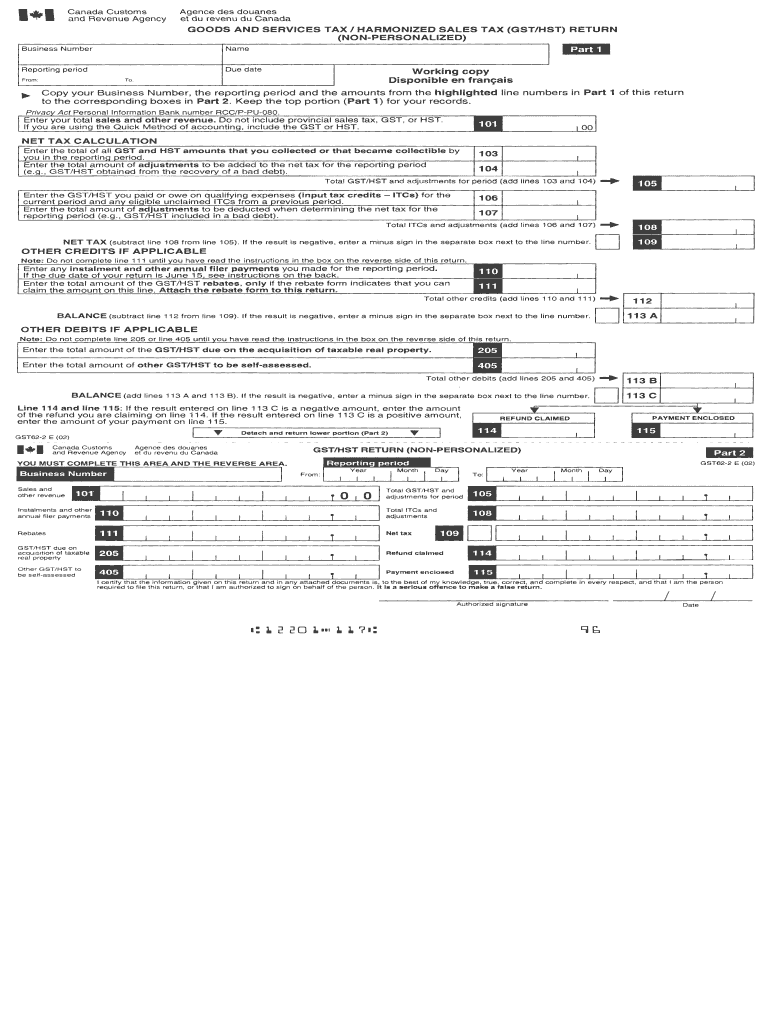

Cra business gst return form. Generally the GST34-2 form should be sent to you automatically so if it hasnt been contact the CRA. The reporting period can be monthly quarterly or annually so be sure to consult with your accountant regarding the reporting period. The difference is you guessed it whether the form is personalized to your business or not.

When you prepare your tax business tax return for the Canada Revenue Agency CRA ITCs are the vehicle for recovering the GSTHST paid out on purchases and expenses related to your commercial activities. How to file your GSTHST Return online using the CRAs Netfile system. We can also use any GSTHST refund or rebate that you are entitled to receive to pay that outstanding amount.

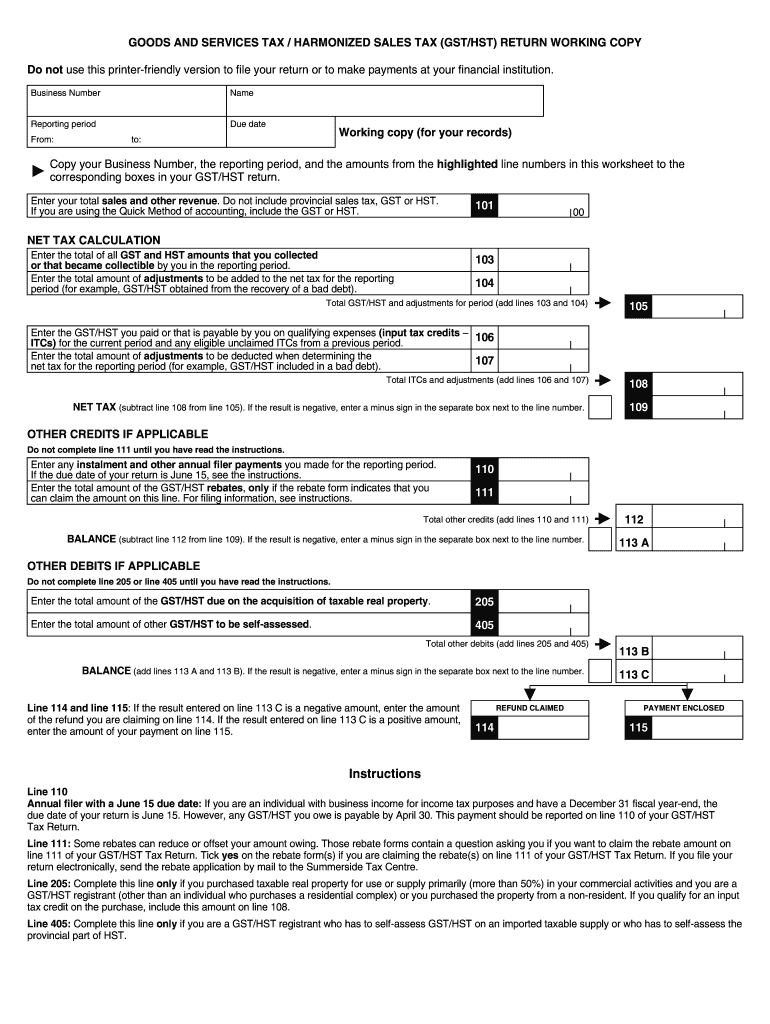

However be aware that you cannot file your sales return in person at a financial institution if you are claiming a refund filing a nil return or opting to offset the owing amount on your return with a rebate or refund. File your GSTHST return Form GST34 File your combined GSTHST and QST return Form RC7200 File any applicable schedules with. Enter all GSTHST you were required to collect as well as all amounts of GSTHST collected on your supplies of property and services.

To file your GSTQST return you can either use the online express service or use the My Account for business website. Call these numbers when you cannot access My Business Account or when you need help with GSTHST NETFILE GSTHST TELEFILE Filing Information Returns Electronically Represent a Client or Payroll Deductions Online Calculator. Include the GSTHST you collected or were required to collect on.

Goods and Services TaxHarmonized Sales Tax Return for Registrants. We pay refund interest according to the prescribed interest rate. The GST44 form must be filed by the purchaser together with his GSTHST return for the reporting period in which the acquisition was made.

The CRA automatically sends a personalized returnForm GST34 Goods and Services TaxHarmonized Sales Tax GSTHST Return for Registrants which includes information specific to the particular business ie. The due date of your return is determined by your reporting period. To get a non-personalized version of the paper return Form GST62 use the Order forms and publications You can also register for My Business Account to view the due dates for your returns make electronic payments or file your GSTHST returns without an access code.

We can charge penalties and intereston any returns or amounts we have not received by the due date. Business accounts include GSTHST except for GST. This line does not appear on an electronic return.

The personalized GSTHST return Form GST34-2 will show the due date at the top of the form. GSTHST TELEFILE you have to fax or drop off your GSTHST return in person at your Tax Centre or Tax Services Office. My Business Account My Business Account is a secure online portal that allows you to interact electronically with the CRA on various business accounts.

You are completing a paper GSTHST return using the regular method. To mail the return you will need to fill the FPZ-500V form sent to you by Revenue Quebec as it is not available online and must be. You are completing a GSTHST return electronically.

The name and address of the business owner and its business number. Eligible individuals can either send the GSTHST return through the mail using forms GST34-2 or GST62 or file in person at your Canadian financial institution. Filing your GSTHST Return and remitting any amount owing.

GST531 Return of Self-Assessment of the First Nations Goods and Services Tax FNGST Election and application forms available to all businesses or individuals GST10 Application or Revocation of the Authorization to File Separate GSTHST Returns and Rebate Application for Branches or Divisions. Input tax credits are the sum of the GSTHST you paid on legitimate business expenses or the allowable portion of the GSTHST paid. If you are closinga GSTHST account you need to file a final return.

Here are the features of each method. This includes all amounts payable and returns required under other programs administered by the CRA. For a complete list of addresses including fax numbers go to wwwcragccatso.

GSTHST NETFILE is an online filing service that allows registrants to file their GSTHST returns and eligible rebates directly to the Canada Revenue Agency CRA over the internet. If you electronically filed your last GSTHST return the CRA will mail you an electronic filing information sheet Form GST34-3. The official names of the forms are either GST34-2 Personalized or GST62 Non-Personalized.

You can file the GSTHST return for your business electronically in various ways depending on your needs and preferences. My Business Account Represent a Client. You may view the status and the details of a previously filed GSTHST return using My Business Account.

These services are available Monday to Saturday from 700 am.

Goods And Services Tax Harmonized Sales Tax Credit Gst Hstc Canada Ca

Goods And Services Tax Harmonized Sales Tax Credit Gst Hstc Canada Ca

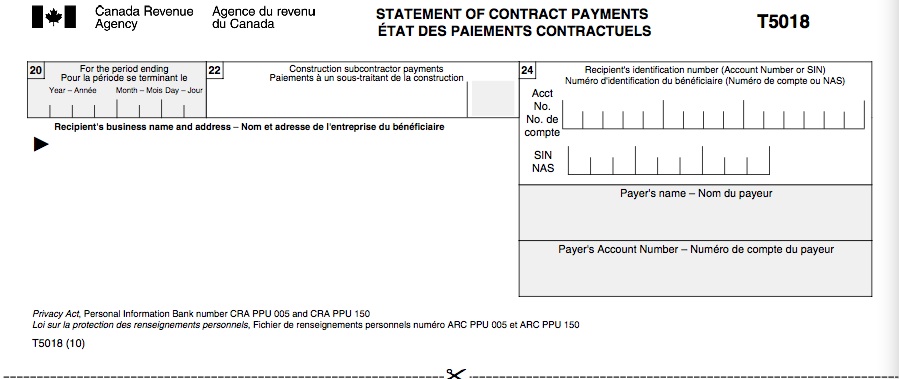

Cra Subcontracting Reporting Requirements

Cra Subcontracting Reporting Requirements

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Tax Hst Gst Form Fill Online Printable Fillable Blank Pdffiller

Tax Hst Gst Form Fill Online Printable Fillable Blank Pdffiller

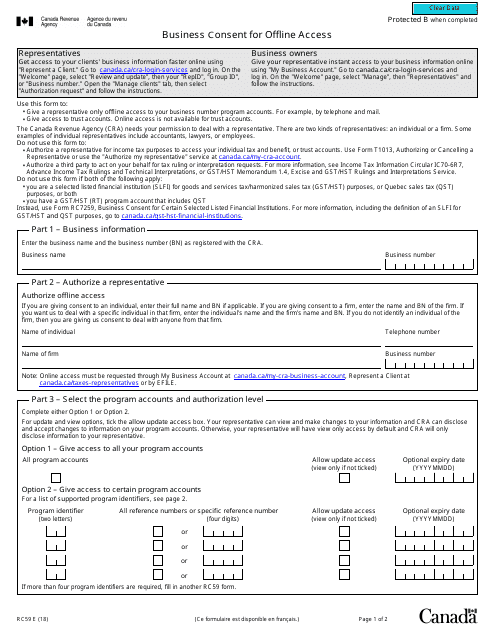

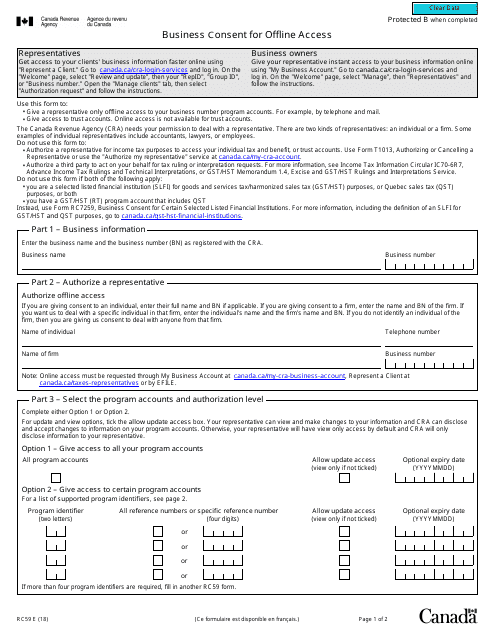

Form Rc59 Download Fillable Pdf Or Fill Online Business Consent For Offline Access Canada Templateroller

Form Rc59 Download Fillable Pdf Or Fill Online Business Consent For Offline Access Canada Templateroller

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Register For A My Cra Login Account Login Filing Taxes Business Tax

Register For A My Cra Login Account Login Filing Taxes Business Tax

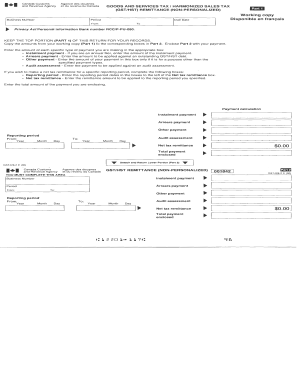

Hst Remittance Form Fill Out And Sign Printable Pdf Template Signnow

Hst Remittance Form Fill Out And Sign Printable Pdf Template Signnow

Get A Gst Number For Your Business In Canada Starting A Business Starting Small Business Small Business Organization

Get A Gst Number For Your Business In Canada Starting A Business Starting Small Business Small Business Organization

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

2020 Form Canada Gst66 E Fill Online Printable Fillable Blank Pdffiller

2020 Form Canada Gst66 E Fill Online Printable Fillable Blank Pdffiller

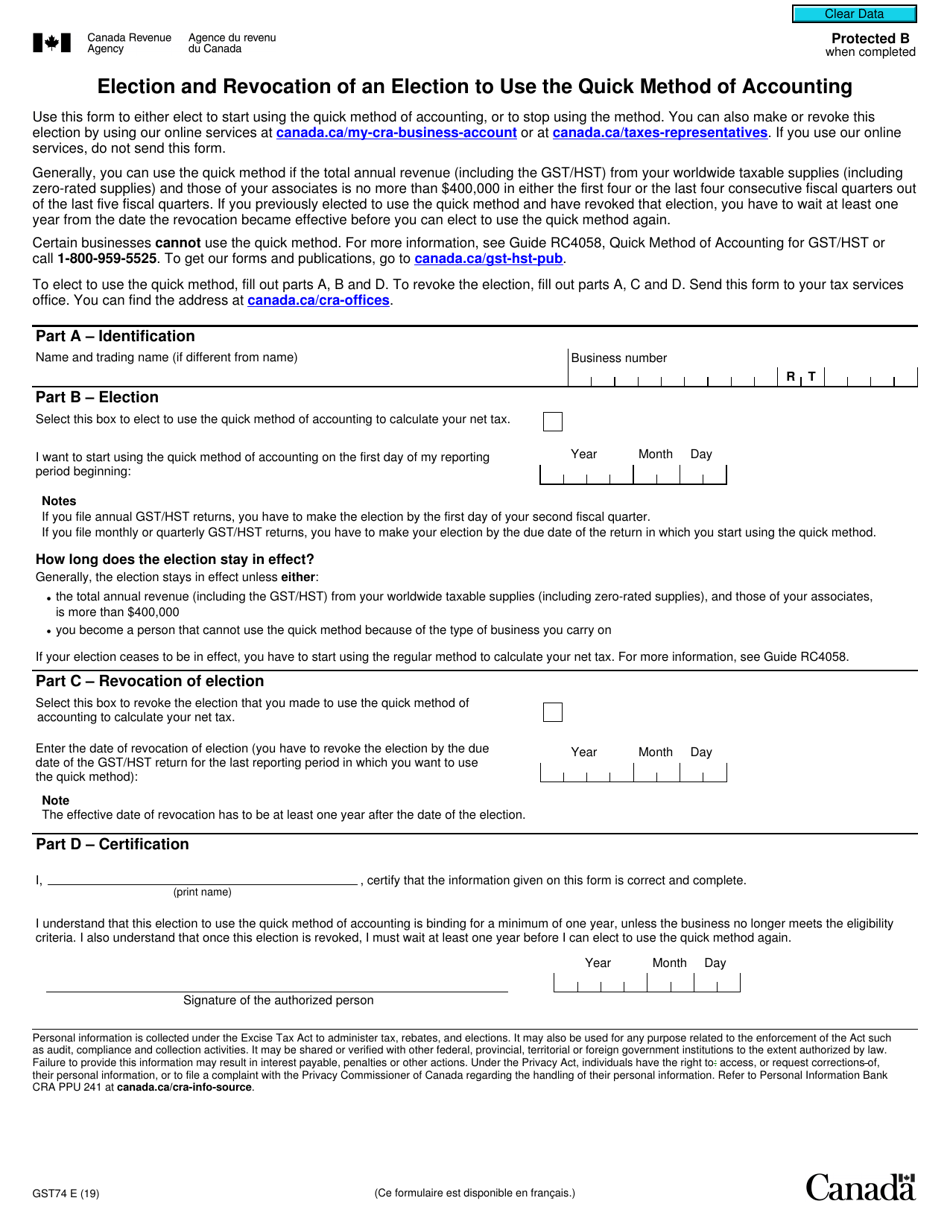

Form Gst74 Download Fillable Pdf Or Fill Online Election And Revocation Of An Election To Use The Quick Method Of Accounting Canada Templateroller

Form Gst74 Download Fillable Pdf Or Fill Online Election And Revocation Of An Election To Use The Quick Method Of Accounting Canada Templateroller

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Ca Gst Fill Online Printable Fillable Blank Pdffiller

Ca Gst Fill Online Printable Fillable Blank Pdffiller

Income Tax E Filing Services In India Online Tax Registration Legal Firm Limited Liability Partnership Filing Taxes

Income Tax E Filing Services In India Online Tax Registration Legal Firm Limited Liability Partnership Filing Taxes

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

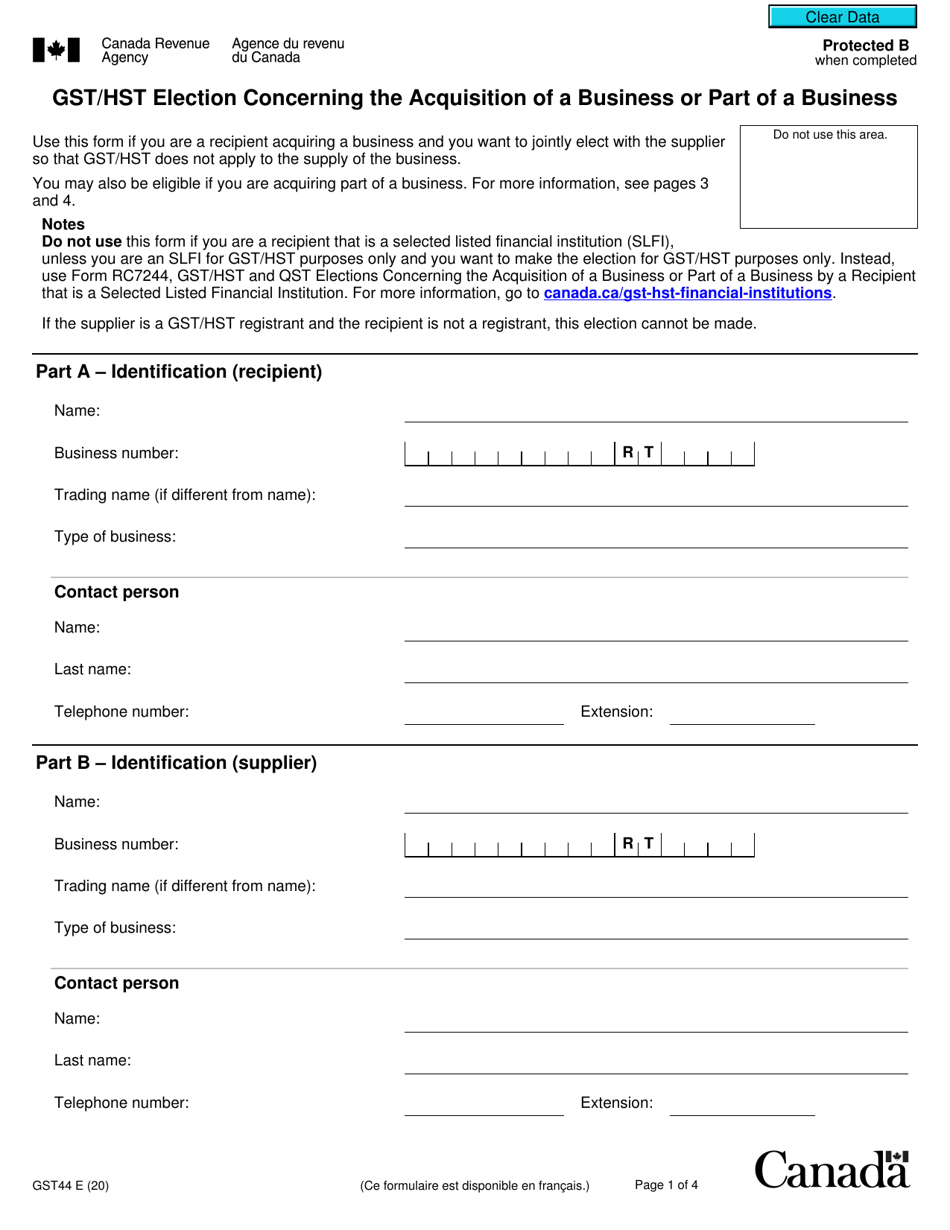

Form Gst44 Download Fillable Pdf Or Fill Online Gst Hst Election Concerning The Acquisition Of A Business Or Part Of A Business Canada Templateroller

Form Gst44 Download Fillable Pdf Or Fill Online Gst Hst Election Concerning The Acquisition Of A Business Or Part Of A Business Canada Templateroller