How To Change Ownership Of Sole Proprietorship Philippines

Register your business in the Bureau of Internal Revenue BIR Go to the Regional District Office RDO where your business is located. Whether you choose option 1 or 2 the sole proprietorships bank account must remain active to clear out old balances.

Converting A Sole Proprietorship To A Corporation Youtube

Converting A Sole Proprietorship To A Corporation Youtube

Then you can voluntarily cancel your business name registration with the DTI and with the other offices where your business is registered.

How to change ownership of sole proprietorship philippines. It is not encumbered by the strict regulatory laws and rules imposed upon corporations and partnerships. Your relative would need to close their business and cancel its business name so that you can adopt the same business type. The first step in selling your sole proprietorship is consulting an attorney.

To voluntarily close or cancel the registration of your proprietorship business you can start by getting a clearance from the Barangay Office where your business is located. The attorney can help you define the documents and contracts that will need to be drawn up and signed by both the buyer and the seller. Heres a step-by-step process for registering a sole proprietorship in the Philippines.

From a tax and legal perspective the AP and AR belongs to the sole proprietorship. Then the private limited liability company can be changed into joint stock corporation however this procedure can be completed by increasing the share capital of the private company and listing it on the Stock Exchange in the Philippines. In the case of Partnership register or create a reconsecuted partnership deed in favour of two sons.

In addition to your completed BIR form 1901 you will need to submit your Certificate of Registration from DTI your Barangay Clearance Certificate your Mayors Business Permit proof of residency and valid ID. Single proprietorship how formed. Sole Proprietorships It automatically terminates by law upon the sole proprietors death or disability.

You will be required to fill out a BIR form 1901 which is an application to register your sole proprietorship. To transfer full ownership of the business without lingering liabilities the original owner must close out all accounts for the business that are in his name. Transfer of Ownership Sole Proprietorship Requirements Ground Floor Sangguniang Panlungsod Bldg Davao City 8000 Philippines Tel No.

The deed for declaring transfer is different from a regular partnership deed. In the case of proprietorship change the ownership from all deeds Bank rent agreements by executing by a settlement deed. Register with the Barangay Office where the business is going to be located to acquire a Barangay Certificate of Business.

Establish the current market value of the assets you are going to sell. Currently there is no way to transfer ownership of a sole-proprietorship business and partnerships. It will make several references to the proprietorship business and will declare the transfer to a partnership firm.

The sole proprietorship will collect customer balances owing and pay bills. You may become a major stockholder and control the corporation yourself. The sole trader can also be changed into a partnership however this is not such a common change in a Philippines company structure.

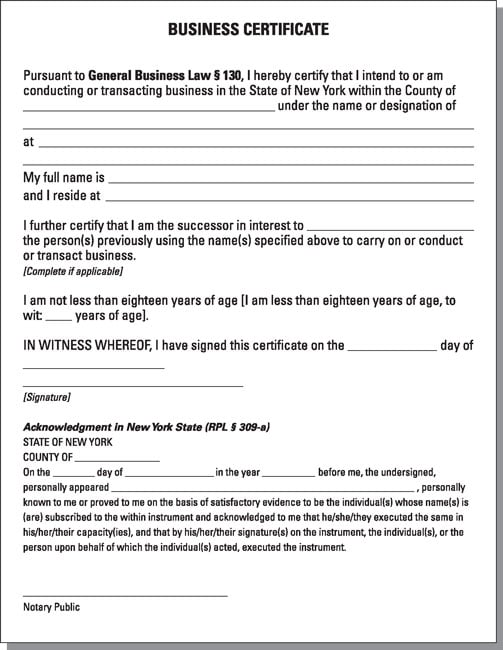

Fill-up the BIR Form 1901 Application for Registration for Sole Proprietor Submit completed registration form together with. A single proprietorship is the simplest form of business organization in the Philippines. If you have operated your sole proprietorship under a Doing Business As DBA name contact the state office where you registered the name.

Register a business name with DTI to acquire a DTI Certificate of Registration. The heirs may elect to sell the business as a going concern or. However ownership is transferable for corporations.

If the proprietor dies the business assets if any will go to the late sole proprietors legal heirs. Register your sole proprietorship Declaration of Transfer. You can incorporate a sole proprietorship at any time of the year but it is best to do it close to the beginning of the year because you must file a different tax return for each business type you operate during the year.

082 241-1000 Loc 378. First address which assets and rights the acquiring sole proprietor wants. Second establish how the acquiring sole proprietor will compensate you.

Consequently the new owner must open new accounts for the business in his own name. Once you have created your corporation you must transfer assets from your sole proprietorship to the corporation. Compensation options range from an immediate lump sum to a series of payments over time.

An attorney can tell you the best process for your jurisdiction and help you define what assets should be included with the sale. Government registration of a single proprietorship business is simple.

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

9 Disadvantages Of Sole Proprietorships Important In 2021

9 Disadvantages Of Sole Proprietorships Important In 2021

Sole Proprietorship Definition Advantages And Disadvantages

Sole Proprietorship Definition Advantages And Disadvantages

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

Notes To Financial Statement Of Sole Proprietorship Philippines 1 Signs You Re In Love With In 2021 Financial Statement Sole Proprietorship Income Statement

Notes To Financial Statement Of Sole Proprietorship Philippines 1 Signs You Re In Love With In 2021 Financial Statement Sole Proprietorship Income Statement

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

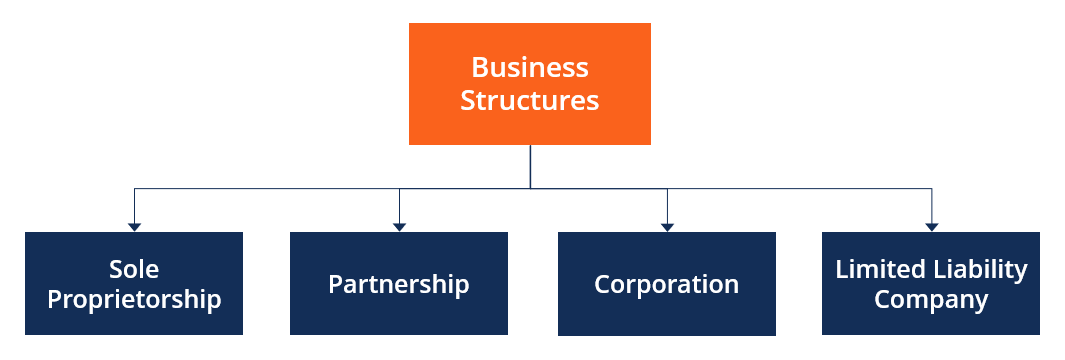

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Advantages And Disadvantages Of Sole Proprietorship Us Small Business Guides Xero Youtube

Advantages And Disadvantages Of Sole Proprietorship Us Small Business Guides Xero Youtube

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

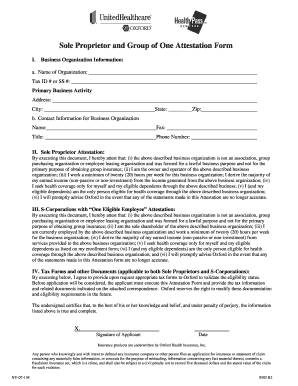

Affidavit Of Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Affidavit Of Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship And Your Import Export Business Dummies

Forms Of Business Ownership Business Ownership Organization Development Business

Forms Of Business Ownership Business Ownership Organization Development Business

How To Do Bookkeeping For Sole Proprietor Explained

How To Do Bookkeeping For Sole Proprietor Explained

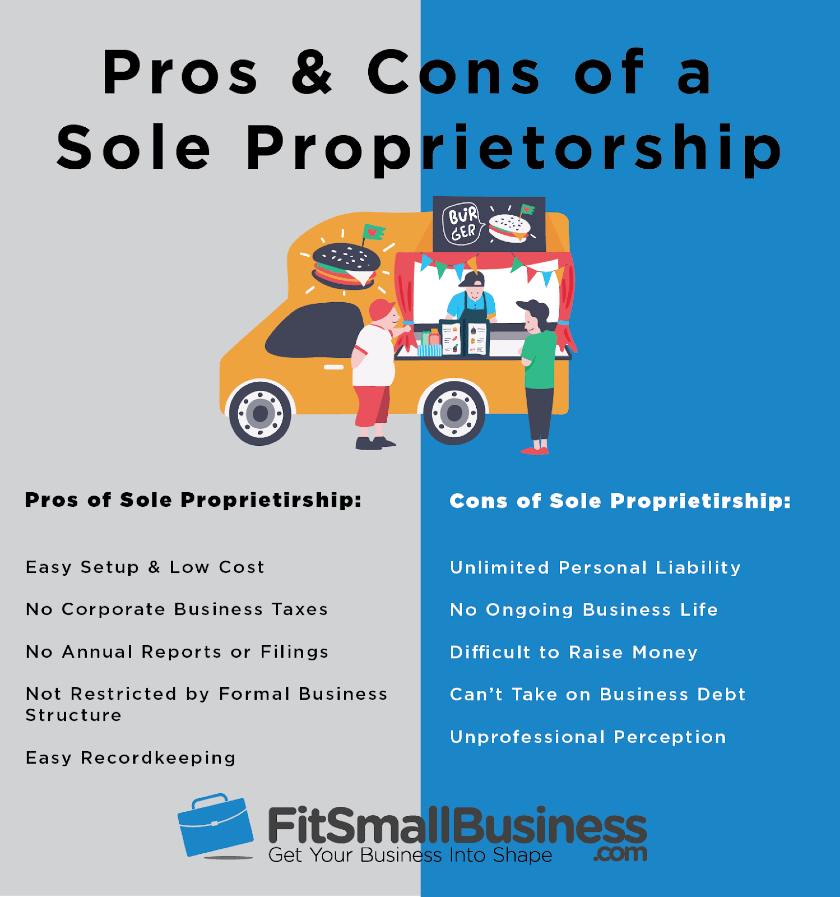

5 Sole Proprietorship Pros And Cons

5 Sole Proprietorship Pros And Cons

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

3 Major Differences Between Sole Proprietorship One Person Corporation Opc Cg Singh Cpa Associates