Former Employer W2 Deadline

The deadline for furnishing copies to employees paper filing or E-filing to SSA is the same ie. W-2 forms must be prepared and provided to employees with copies sent to the Social Security Administration on or before Monday February 1 2021.

Earlier Filing Deadlines In 2017 For Forms W 2 And 1099 Published By Schaumburgcpa On Edocr Independent Contractor Form Downers Grove

Earlier Filing Deadlines In 2017 For Forms W 2 And 1099 Published By Schaumburgcpa On Edocr Independent Contractor Form Downers Grove

The IRS must also hold some refunds until Feb.

Former employer w2 deadline. You must furnish Copies B C and 2 of Form W-2 to your employees by February 1 2021. The Internal Revenue Service is reminding employers and small businesses of a new Jan. That is also the date the Forms W-2 are due to workers.

Your W-2 form reports your years wages and the taxes withheld and is also sent to the IRS. If you have changed jobs in the past year you must still get a W-2 from your former employer to file your taxes properly. Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan.

The deadline date by which you need to have distributed W-2s to employees is January 31st. You can also distribute Form W-2 electronically. Your employees dont have to physically have the forms by that date but the deadline to mail W-2 forms is January 31.

31 employers can be assessed a 100 fine. All employers are legally obligated to send your W-2 to you no later than January 31 st of each calendar year. If you fail to hit submit by midnight penalties await.

At the beginning of each year companies send all their employees W-2s that include information about the previous years earnings and taxes. Hello xxtexasxxsweethe Employers are required to send W-2s to employees by January 31. If employees and the SSA do not receive W-2s by Aug.

31 filing deadline for Forms W-2. If you still do not receive your W-2 by February 15th you can contact the IRS at httpswwwirsgovnewsroomform-w2-missing-irs-can-help or call 800-829-1040. This is also the date Form W-2s are due to employees.

Send Copies B C and 2 of Form W-2 to each employee by January 31. Employers have until January 31 to mail out W-2s which means your W-2 should arrive any day now. For filing W-2 forms between 31 and 59 days late employers can be fined 60 for each late W-2 form.

A W-2 form is an important document to have when filing your annual taxes. What if its February but I still dont have my W-2 Say Thanks by clicking the thumb icon in a post. Electronic Wage Reporting Forms W-2 Specifications for Filing Forms W-2 and W-2c Electronically EFW2EFW2C Tax Year 2020 Substitute W-3W-2 2-D Barcoding Standards.

Dont worry if youre not preparedwell explain everything you need to know. Employees dont technically have to have W-2s in hand but at a minimum the envelope must bear an official January 31st or earlier postmark. A new federal law aimed at making it easier for the IRS to detect and prevent refund fraud will accelerate the W-2 filing deadline for employers to Jan.

Electronic Data Transfer Guide. Your deadline for handing out the form to employees is January 31st and that for filing with the IRS is March 31st. One of those deadlines is the employer w2 deadline - the date by which you must send your W-2s to the IRS.

You can also check our database to find your W-2 online. Publication 15 Circular E Employers Tax Guide--Reporting Sick Pay. If your former employer is no longer in business they are still obligated to provide you with a W-2.

That is the absolute last day to send out W-2s. By law employers are required to file copies of their Form W-2 Wage and Tax Statement and Form W-3 Transmittal of Wage and Tax Statements with the Social Security Administration by January 31. More info What if my employer did not give me a W-2.

If the 31st of January falls on a weekend your employer will have a few more days to send it out before the W-2 deadline. W-2s can also be electronically distributed. Make sure youre also aware of the newly updated penalties for late or false reporting listed below.

Your last paystub is NOT the same thing as your W-2. Most employers will hand out or mail your W-2 form by January 31st at the latest. If you are waiting on a corrected W-2 from your employer the link provided below provides some things you can do while waiting.

The document provides detailed information about your entire years wages and any taxes that have been withheld which is essential for you to file your return. The due date for filing Forms W-2 and W-3 with the SSA is now February 1 2021 whether you file using paper forms or electronically. Social Security Number Randomization Frequently Asked Questions.

A 2015 law made it a permanent requirement that employers file copies of their Form W-2 Wage and Tax Statement s and Form W-3 Transmittal of Wage and Tax Statements with the Social Security Administration by January 31. However since January 31 falls on a Sunday in 2021 the. If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it.

This means you may not receive it until the first or second week of February. Employers must file Form W-2 and other wage statements by Monday February 1 2021.

Which Form Should An Employer Use A W 2 Or A 1099 Nec Business Tax Payroll Taxes What Is Social

Which Form Should An Employer Use A W 2 Or A 1099 Nec Business Tax Payroll Taxes What Is Social

How To File Form 1099 Misc Online For Independent Contractors Irs Forms Irs Independent Contractor

How To File Form 1099 Misc Online For Independent Contractors Irs Forms Irs Independent Contractor

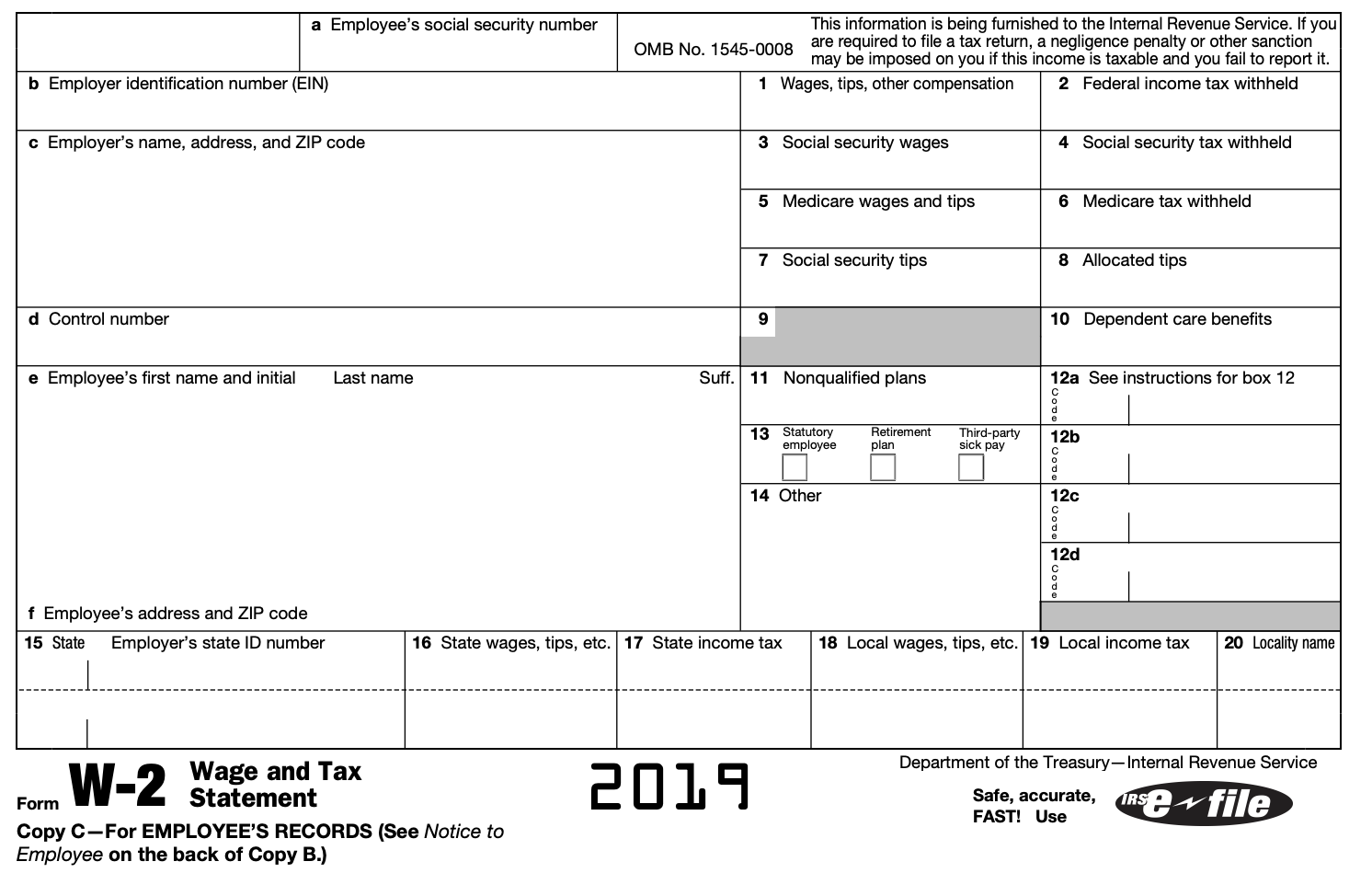

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

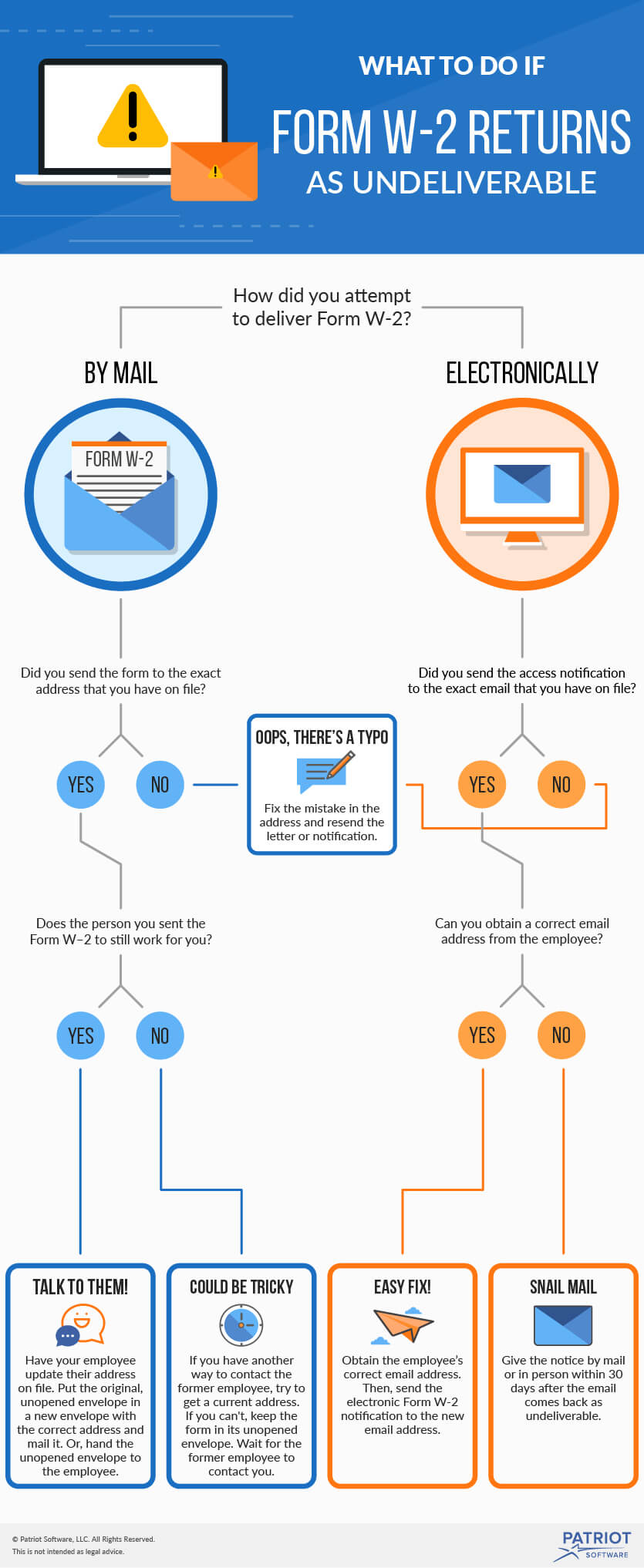

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

Reminder Submit W 2 Changes Southland Data Processing

Reminder Submit W 2 Changes Southland Data Processing

Cook Reminds Employers Business Owners Of Jan 31 Filing Deadline For Wage Statements Independen Independent Contractor Franchise Opportunities Payroll Taxes

Cook Reminds Employers Business Owners Of Jan 31 Filing Deadline For Wage Statements Independen Independent Contractor Franchise Opportunities Payroll Taxes

W 2 Form Filing Deadline And Faqs Square

W 2 Form Filing Deadline And Faqs Square

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Understanding Your Tax Forms Form W 2 Wage And Tax Statement Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms Form W 2 Wage And Tax Statement Tax Forms W2 Forms Tax Time

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

2020 W 2 See What Last Year S Changes Bring To The Form

2020 W 2 See What Last Year S Changes Bring To The Form

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

Did Your Job Not Send You A W2 Its Passed The Deadline 2020

Did Your Job Not Send You A W2 Its Passed The Deadline 2020

Pin By Bianca Kim On W 2 Irs Tax Forms Tax Forms Irs Taxes

Pin By Bianca Kim On W 2 Irs Tax Forms Tax Forms Irs Taxes