How Do I Get A Tax Exempt Certificate In Colorado

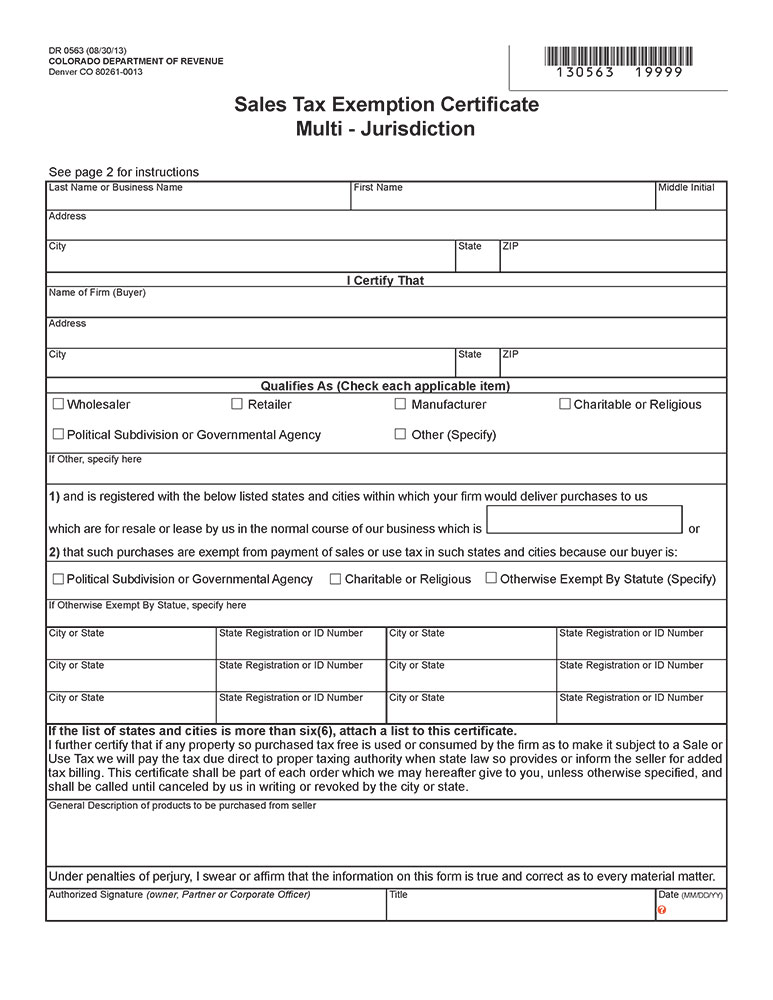

Colorado provides an exemption for organizations that have been certified exempt under 501c3 of the Internal Revenue Code. You can download a PDF of the Colorado Multi-Jurisdiction Sales Tax Exemption Certificate Form DR0563 on this page.

Https Leg Colorado Gov Sites Default Files 2020 Te28 Railroad Exemptions Pdf

Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt.

How do i get a tax exempt certificate in colorado. California Sales Tax Exemption Certificate Supporting Bill of Lading. Any other information required by that particular certificate. Applying for Tax Exempt Status.

A copy of the Certificate of Exemption should be retained with this completed Affidavit. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Exemptions Application forms are new as of November 13 2018.

Exempt License for Contractors. For organizations located outside. Step 1 Begin by downloading the Colorado Sales Tax Exemption Certificate Form DR 0563 Step 2 Identify the business name and business address of the seller Step 3 Identify the name and business address of the buyer Step 4 Check the reasons why the buyer qualifies to not pay sales tax.

All registrations are subject to review and approval based on state and local laws. 1 used in Colorado 2 purchased for more than 500 3 of such nature that they would have qualified for the federal investment tax credit provided by section 38 of the Internal Revenue Code of 1954 as amended and. 39-26-718 1 a CRS Organizations that are exempt from federal income tax under 501 c 3 will generally be approved for a Certificate of Exemption in Colorado.

Also exemptions may be specific to a state county city or special district. To apply for this certificate with Colorado use the Application for Sales Tax Exemption for Colorado Organization DR 0715. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number.

When approved the nonprofit will not be required to pay federal income taxes. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. How to use sales tax exemption certificates in Colorado.

You must give the exemption certificate to the seller within 90 days after the date of the purchase. The following documents must be submitted with your application or it will be returned. No fee is required for this exemption certificate and it does not expire.

If you began on the earlier form you may complete and submit it. Colorado allows charitable organizations to be exempt from state-collected sales tax for purchases made in the conduct of their regular charitable functions and activities. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase.

Steps for filling out the DR 0563 Colorado Sales Tax Exemption Certificate. Use your Home Depot tax exempt ID at checkout. DR 0511- Affidavit for Colorado Sales Tax Exemption for Farm Equipment DR 0563 - Sales Tax Exemption Certificate Multi-jurisdiction DR 0715 - Application for Sales Tax Exemption for Colorado.

For more information please refer to the Form 1023 product page. At the state level some states offer tax-exempt status as well meaning the net profit will be exempt from state income tax payments. Certificate of Exemption Sales to the United States and Its Instrumentalities Civilian Welfare Funds 16201.

For more information review the Tax Exemption Qualification. For other Colorado sales tax exemption certificates go here. Affidavit for Section 6388 or 63885 Exemption from California Sales and Use Tax.

Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. All valid non-profit state exemption certificates start with the numbers 98 or 098. As of January 31 the IRS requires that Form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov.

Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Mail the form to the applicable IRS office listed below. You do not have to start a new form.

To request a copy of either the exemption application including all supporting documents or the annual information or tax return submit Form 4506-A Request for Public Inspection or Copy of Exempt Organization IRS Form PDF. Certain products and services are exempt form Colorado state sales tax. Only organizations exempt under 501 c 3 of the Internal Revenue Code will be.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Colorado sales tax. To qualify for exemption machinery machine tools or parts thereof must be. To gain tax-exempt status you must apply with the Internal Revenue Service IRS and receive approval.

A Certificate of Exemption is issued to the organization when granted exemption by the Colorado. Four of the following qualifying criteria. The purchasers signature or an authorized representatives signature.

Sellers show are registered in one of Colorados many home-rule cities should be able to use their sales tax license number as a resale certificate as well If you do have a Colorado sales tax license note that Colorado sales tax licenses and thus resale certificates are renewed every two years.

Https Www Colorado Gov Pacific Sites Default Files Disabled 20veterans 20exemption 20form Pdf

Fill Free Fillable Colorado Department Of Regulatory Agencies Pdf Forms

Fill Free Fillable Colorado Department Of Regulatory Agencies Pdf Forms

Https Coloradosprings Gov Sites Default Files Contractors Rules Lump Sum Contracts Overview Pdf

Stumped How To Form A Colorado Llc The Easy Way

Printable Colorado Sales Tax Exemption Certificates

Printable Colorado Sales Tax Exemption Certificates

Https Www Colorado Gov Pacific Sites Default Files Sales57 Pdf

Https Www Colorado Gov Pacific Sites Default Files Sales75 Pdf

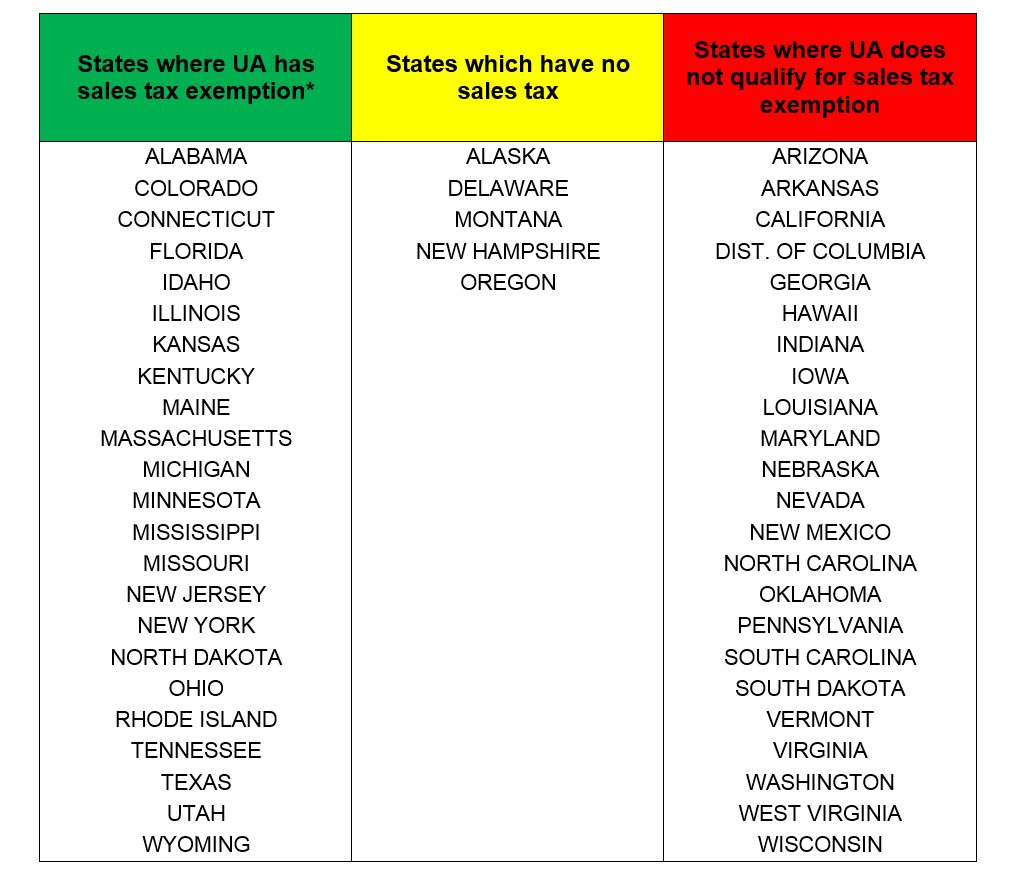

Other States Tax Exemption Tax Office The University Of Alabama

Other States Tax Exemption Tax Office The University Of Alabama

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Colorado Tax Forms 2020 Printable State Co 104 Form And Co 104 Instructions

Colorado Resale Certificate Trivantage

Colorado Resale Certificate Trivantage

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Https Www Sos State Co Us Ccr Generaterulepdf Do Ruleversionid 6583 Filename 1 20ccr 20201 2

Https Www Colorado Edu Psych Neuro University Tax Exempt Certificate

Https Www Colorado Gov Pacific Sites Default Files 11agriculture 20legis Pdf

Https Www Colorado Gov Pacific Sites Default Files Sales04 Pdf

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Https Www Colorado Edu Psych Neuro University Tax Exempt Certificate