How To Generate A 1099 In Quickbooks

Choose the Contractors tab. For instructions on correcting your 1099s refer to this Tax 1099 article Different types of 1099.

Create and file 1099s using QuickBooks Online.

How to generate a 1099 in quickbooks. Select vendors who need 1099 and click on Continue. Click 1099 contractors below the threshold. From the Expenses menu select Vendors.

This tutorial will give you the basics of who needs a 1099 and why and will demonstrate how to create those 1099s i. Using the Recipients ID Number drop-down menu select the 1099 form to correct. Click the Lets get started green button to begin the 1099 setup process.

At the Forms Selection screen select the type of 1099 you wish to correct ie. Click on the Prepare 1099s button. Click the Prepare 1099s button.

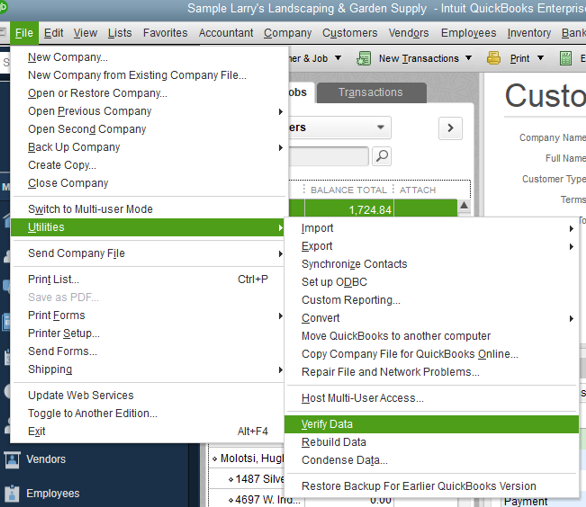

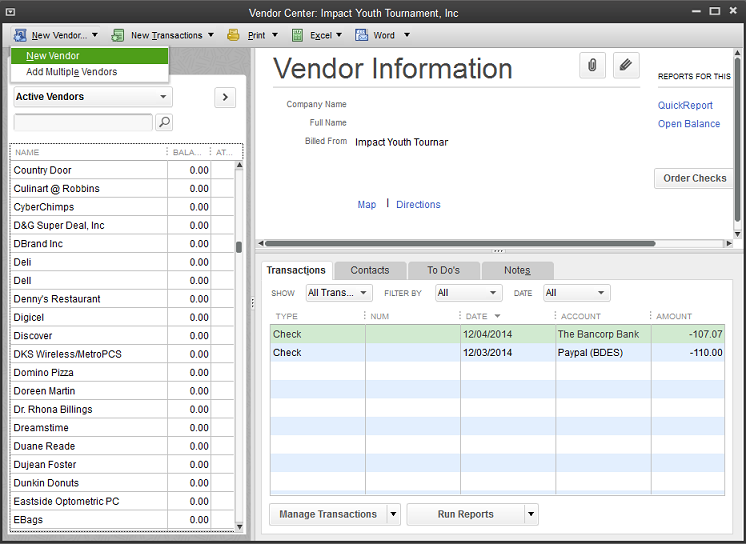

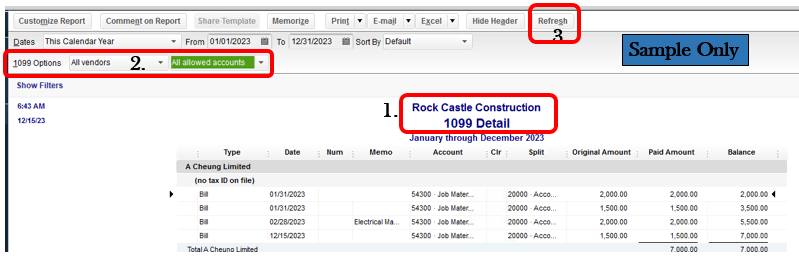

To create a report of payments to vendors that need to go on Form 1099-MISC To help with end-of-year filings run a report of all the payments you made this year to your 1099 vendors. The procedure to create 1099s in QuickBooks Desktop involves the following steps. This button is also located in the Vendor Center.

Create Custom Invoice Template Quickbooks. If you want to sort the report by 1099 vendors. Go to the Workers menu.

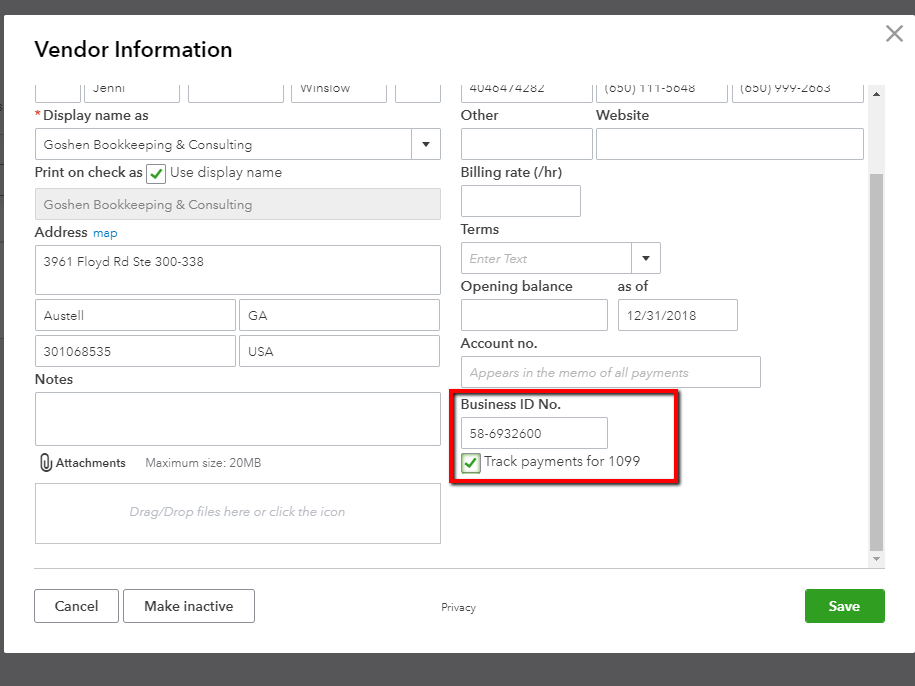

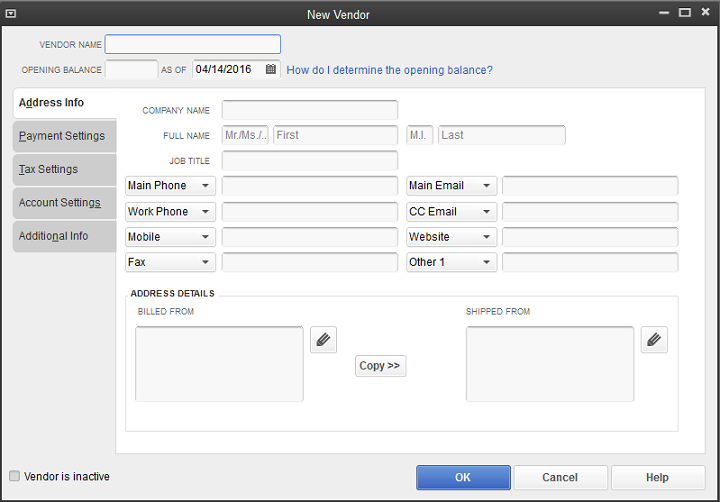

From the RowsColumns drop-down menu select Change columns. Click on the Tax Settings tab and enter the contractors tax identification number or Social Security number if the vendor is a sole proprietor. Heres how to get the report that lists all of your 1099 vendors.

Need to create 1099 forms in QuickBooks. If you select the View forms button youll only get Copy A that we sent to the IRS. Wishing you a great day ahead.

Click on PrintE-File 1099 Forms. Once there go to the Type of contractors drop-down arrow. Select Contractors from the sub-menu and then click Add your first contractor Enter the name and.

Create Batch Invoices In Quickbooks Online. Contractors will also have to receive Form 1099-MISC though if they are paid a minimum of 600. Start QuickBooks and go to Vendors.

The Community is always open if you have other questions while pulling up 1099 reports. Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. How to Prepare 1099 Tax Forms with QuickBooks Desktop.

Create Multiple Invoices In Quickbooks Online. Click on the Workers tab then select Contractors. How To Create 1099 Forms In Quickbooks Online.

Select the Track 1099 checkbox. Select the Sort drop-down menu. Im also sharing these articles in case you need a reference while working with 1099s in QBO.

In this video we will review the 1099 wizard that QuickBooks Online Plus provides for processing 1099 forms for your independent contractorsIf you enjoyed t. You can correct your 1099-NEC or 1099-MISC in Tax1099. View and download and Submit 1099 Forms.

Search for Vendor Contact List and open the report. To set up a 1099 employee in QuickBooks Online follow the below steps. Check Vendor eligible for 1099 Verify the tax.

Go to Step number 4 by clicking Next. If the email address field is left blank well still e-deliver the 1099 copy to the email address previously saved in your QuickBooks Online account. Other 1099 copies are available from the Home page.

How to set up contractors and track them for 1099s in QuickBooks. From the main dashboard click the Workers tab on the left-hand side. You can pay contractors through QuickBooks Onlines Payroll system.

Ill be around to help. Click Finish preparing 1099s. According to the IRS contractors are workers that are not considered employees because they dont perform work that the company could do on their own.

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

Quickbooks 1099 Year End To Dos 1099 Preparation Tips

Quickbooks 1099 Year End To Dos 1099 Preparation Tips

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

How To Enter A 1099 Into Quickbooks Desktop And Track Time Youtube

How To Enter A 1099 Into Quickbooks Desktop And Track Time Youtube

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Easy Way To Prepare Quickbooks 1099 Misc Forms

Easy Way To Prepare Quickbooks 1099 Misc Forms

Prepare 1099 S With Quickbooks Experts In Quickbooks Consulting Quickbooks Training By Accountants

Prepare 1099 S With Quickbooks Experts In Quickbooks Consulting Quickbooks Training By Accountants

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Print 1099s In Quickbooks Online

How To Print 1099s In Quickbooks Online