Self Employed Business Expenses Form Canada

Business use of a motor vehicle. To help calculate your business-use-of-home expenses complete the Calculation of business-use-of-home expenses.

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

This includes expenses such as phones internet and utilities.

Self employed business expenses form canada. The only restriction on these amounts is if membership dues are paid to a club where the main purpose of the club is dining recreation or sporting activities - these expenses are not deductible. To deduct your cell phone as a business expense note your costs on Form T2125 Statement of Business and Professional Activities. In guide T4002 Self-employed Business Professional Commission Farming and Fishing Income.

Food beverages entertainment You can claim up to 50 deductions on the meal expenses you pay for the fiscal year. This information is for self-employed. Sep 16 2020 If you are self-employed the Canada Revenue Agency allows you to deduct a range of business expenses.

Sep 30 2020 If you earn self-employed income and use your motor vehicle for the purpose of earning a profit then you will be able to claim the related business expenses on your income tax return and use them to reduce the amount of taxable business income you earned. On Form T2125 Part 7. Business Operating Expenses Any money you spend running your business is considered.

If you are a self-employed person enclose either your financial statements or form TP-80-V Business or Professional Income and Expenses with your income tax return TP-1-V to report your business income. The expenses you claim cannot have been claimed elsewhere on Form T2125. You can deduct expenses you incur to run a motor vehicle you use to earn business income.

Here is a look at the main deductions you can claim. The daily flat rate that can be claimed is 23. This form helps you calculate.

Nov 20 2019 The Canada Revenue Agency CRA allows self-employed Canadians to write-off expenses reasonably incurred while pursuing profit for your business. Mar 05 2013 Business tax fees licenses dues memberships and subscriptions This category of expense is fairly self explanatory. These expenses offset your income lowering your profits on paper and reducing your tax burden.

May 14 2020 The T2125 also provides self-employed Canadians with the opportunity to deduct allowable expenses from your gross income to lower your taxable income so you pay less in income taxes. When youre self-employed these deductions can have a big impact on your bottom line by reducing the amount of tax that you have to pay. Of form T2125 Statement of Business or Professional Activities form T2042 Statement of Farming Activities or form T2121 Statement of Fishing.

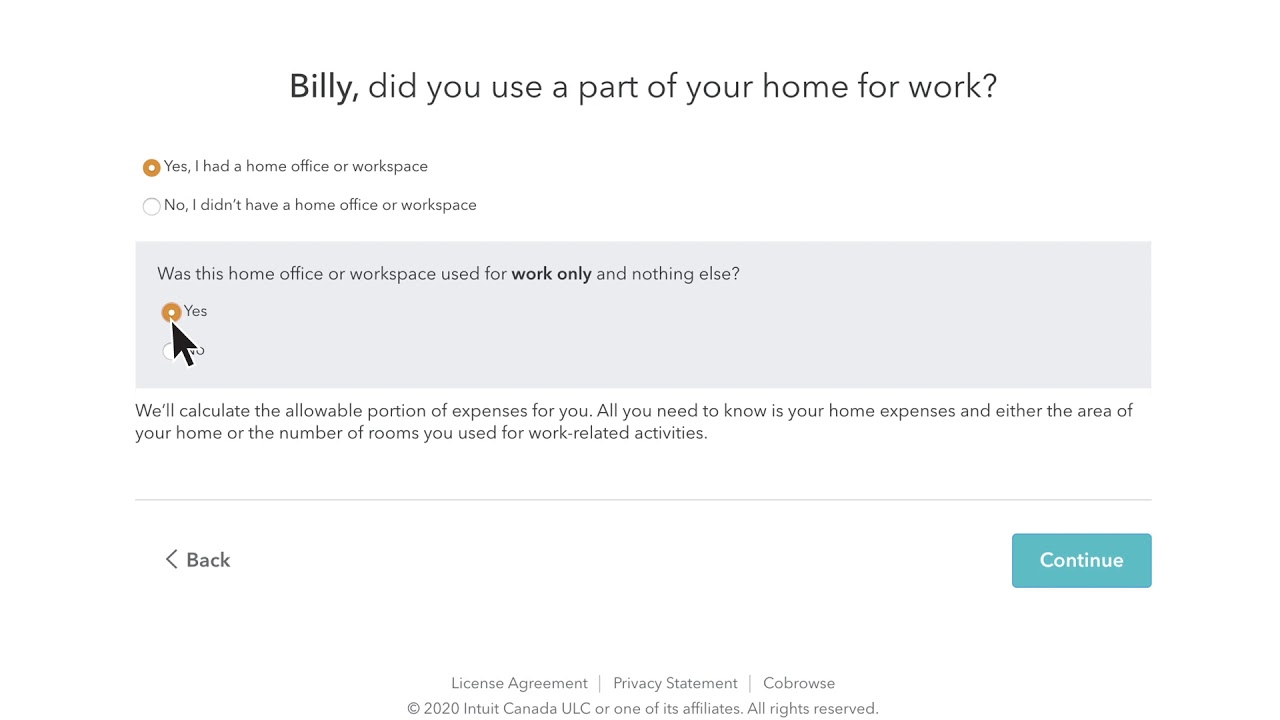

This list is relevant for many self-employed professionals. Nov 07 2019 The Canada Revenue Agency CRA allows Taxpayers to deduct business-use-of-home self-employed or workspace-in-the-home employee expenses from your income which lower the amount of taxable income being claimed which reduces the overall tax burden. If your sole-proprietorship or partnership business makes more than 30000 a year you will need to file form GST34 the GSTHST return.

To calculate the amount of motor vehicle expenses you can deduct fill in Chart A Motor Vehicle Expenses. On line 9281 of your T2125 form Motor vehicle expenses you may be eligible to claim. For an example of the calculation of these expenses go to Calculating business-use-of-home expenses.

Remember however that you can only deduct the business use of the expense youre deducting. For each business you operate you must provide separate financial statements or complete a separate copy of form TP-80-V. For more information see Chapter 5 Eligible capital expenditures.

They can deduct the cost of the extra food and beverages they must consume in a normal working day 8 hours because of the nature of their work. Dec 15 2020 Form GST34. Sep 02 2020 Some of the expenses that you have as a self-employed Canadian have rules for how much you can claim on deductions.

Jan 01 2017 Extra food and beverages consumed by self-employed. Your business will need to register for a GSTHST number in order to file this return. This allows the CRA to collect on the harmonized sales tax of your business.

These expenses can range from advertising to utilities and everything in between. Treat the value of the inventory as a purchase of goods for resale and include it in the calculation of cost of goods sold in your income statement at the end of the year. Deductible expenses are those that are seen as ordinary and necessary for conducting business.

This form combines the two previous forms T2124 Statement of Business Activities and T2032 Statement of Professional Activities. Use this form to report either business or professional income and expenses.

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

Self Employment Income Statement Template Beautiful Business Profit And Loss Statement For Self E Profit And Loss Statement Income Statement Statement Template

Self Employment Income Statement Template Beautiful Business Profit And Loss Statement For Self E Profit And Loss Statement Income Statement Statement Template

Profit Loss Statement Example Best Of Profit And Loss Template Strong Illustration Templates Profit And Loss Statement Income Statement Statement Template

Profit Loss Statement Example Best Of Profit And Loss Template Strong Illustration Templates Profit And Loss Statement Income Statement Statement Template

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Best Free And Simple Templates

Self Employed Invoice Template Best Free And Simple Templates

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

What Are Miscellaneous Expenses Quickbooks Canada

What Are Miscellaneous Expenses Quickbooks Canada

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Pin On Start Your Own Business Small Business Tax Business Tax Business Tax Deductions

Pin On Start Your Own Business Small Business Tax Business Tax Business Tax Deductions

Americans Working In Canada And Taxes

Self Employment Ledger Forms Luxury Blank General Ledger General Ledger Bookkeeping Templates Small Business Planner

Self Employment Ledger Forms Luxury Blank General Ledger General Ledger Bookkeeping Templates Small Business Planner

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Expense Sheet

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Expense Sheet

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

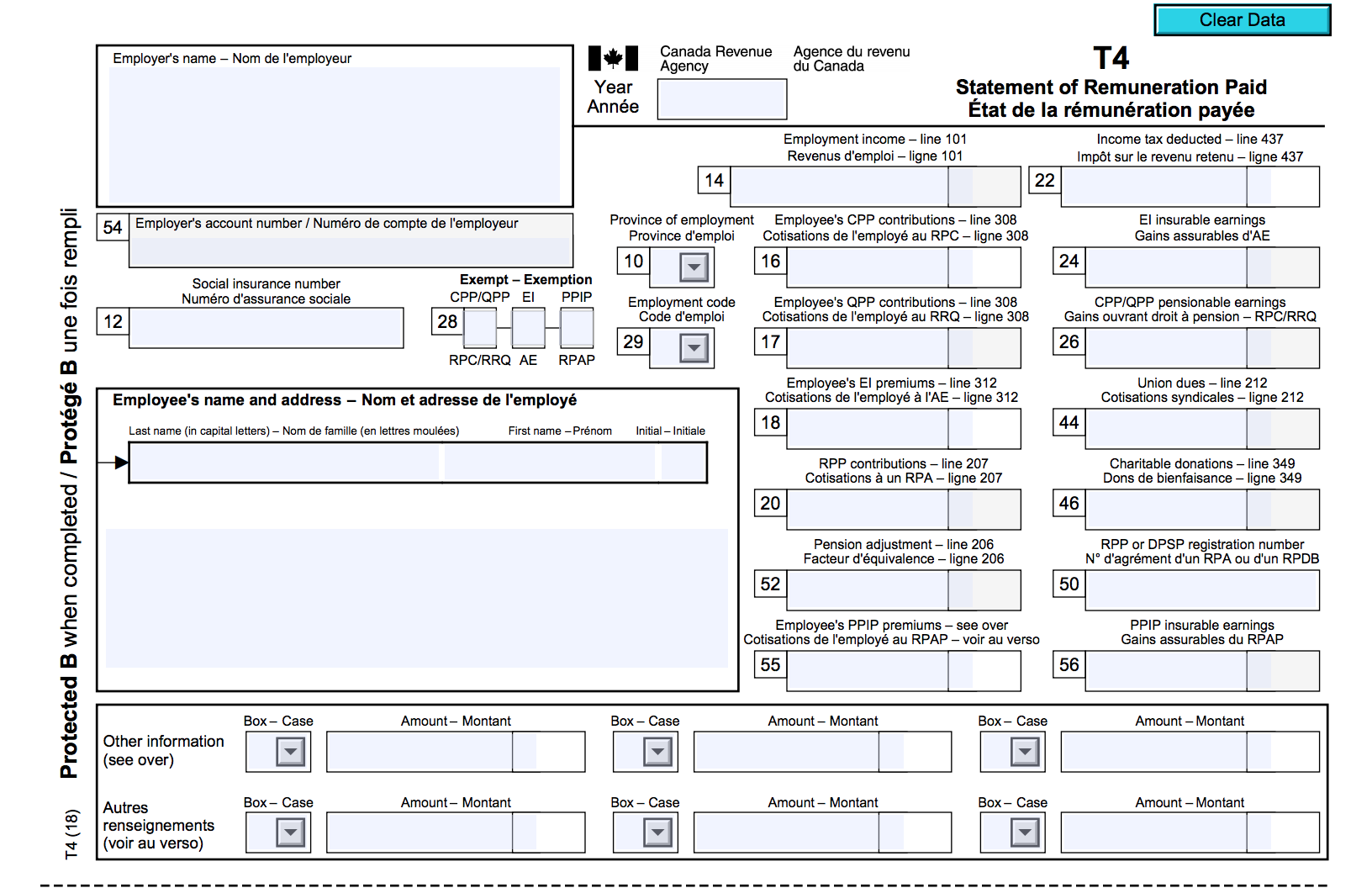

The Canadian Employer S Guide To The T4 Bench Accounting

The Canadian Employer S Guide To The T4 Bench Accounting

Self Employed Invoice Template Best Free And Simple Templates

Self Employed Invoice Template Best Free And Simple Templates