Do Printing Services Get A 1099

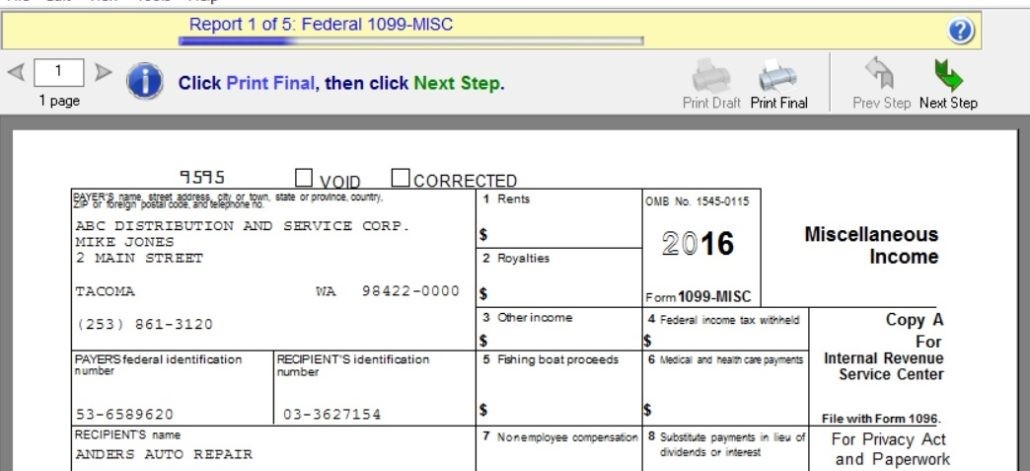

Click Vendors choose PrintE-file 1099s. Select the appropriate year and click View 1099G.

2017 Is Almost Over And While We Are In This Busy Season Is Always Good To Be Looking Ahead Before You Know It Your Tax Forms Printing Services Filing Taxes

2017 Is Almost Over And While We Are In This Busy Season Is Always Good To Be Looking Ahead Before You Know It Your Tax Forms Printing Services Filing Taxes

You can view or print your forms for the past seven years.

Do printing services get a 1099. MUST be removed before printing. Our Service Bureau can handle all of your printing and mailing needs for all supported forms. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

There are two copies of this form. Think of this form as the equivalent of the W-2 you would receive from an employer if you worked for wages or a salary. In the Select your 1099 vendors window check off the vendors who.

¾ Non-Employee Compensation Form 1099 MISC Box 7 Advertising Auto Repair Construction CustodialMaintenance Landscapers Locksmiths Photographers Printing Services. Youll want to print and mail in time for IRS filing and contractor delivery deadlines. If you cannot access your 1099-G form you may need to reset your password within IDESs secure website.

The Internal Revenue Service mandates that every company that hires another to provide services or lease business space must issue 1099s when payments made in a given tax. 2020 Instructions for Forms 1099-MISC and 1099-NEC Miscellaneous Income and Nonemployee Compensation Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. When a business pays an independent contractor for services performed in the course of that business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation.

We also offer options where you can choose Print Mail only. How to Get Your 1099-G online. The 1099-NEC reports money received for services provided by independent contractors freelancers and sole proprietors.

Intuit offers 1099 Forms two per sheet with size 8 12 x 11 that includes compatible double-window envelopes with size 5 58 x 8 34. Direct Sales The law requires information reporting on Form 1099 MISC for certain direct sellers. If you dont have access to a printer you can save the.

1099 Printing and Mailing Service. To access this form please follow these instructions. Your accounting software will be able to do this for you and print them out or turn them into a PDF to email or submit electronically.

Reemployment Assistance benefits are taxable income. The total for the. Amounts The cutoff for sending a 1099 for services rendered is 600.

You can elect to withhold 10 of your weekly benefit amount to cover your taxes due to the IRS. The default filing option includes printing and mailing. May 31 2019 508 PM According to the IRS if you pay an independent contractor more than 600 in a single year and you made the payment for services in the course of your trade or business you have to file Form 1099-MISC Miscellaneous Income to report payments for services performed for your trade or business.

Do not use Form 1099-MISC to report scholarship or fellowship grants. This can be handled after logging into your claim under View and Maintain Account Information and selecting Payment Method and Tax Withholding Options. We can print fold stuff and mail any quantity of forms.

Therefore you dont prepare 1099s for the purchase of materials insurance or newspaper advertising for instance. Select 1099 Wizard click Get Started. Select the appropriate year and click View 1099G.

The person you pay must be providing a service to your business and not selling you something. The magic number here is 600. Our price includes all postage and handling.

Purchase your 1099 Kit by mid-January so you can print. As part of our 1099 outsourcing services we provide printing and mailing services for 1098 1099 and W-2 forms. While for E-filed 1099 forms you can print the copies on a plain paper.

Print and Mail 1099 1098 W-2 and ACA Forms. Once you have all of the required information use it to fill out Form 1099-MISC. You can log into CONNECT and click on My 1099G49T to view and print the forms.

Heres how to print your 1099 form. As part of our 1099 processing services we print and mail recipient copies of 1098 1099 and W-2 forms. If you pay that much money to your ad agency or the printer making your fliers the company gets a 1099-MISC.

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income SSI. Copy A which you submit to the IRS and Copy B which you send to your vendor. If you do not have an online account with NYSDOL you may call.

DO NOT automatically treat a payee as a corporation simply because the payees name ends with LLC Company or Co EXAMPLES OF REPORTABLE PAYMENTS. A replacement SSA-1099 or SSA-1042S is typically available for the previous tax year after February 1. Affordable 1099 fulfillment Service.

We Print Tax Forms Tax Forms Printing Services Print

We Print Tax Forms Tax Forms Printing Services Print

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Sage 100 Consultant How To Print W2s And 1099s And How Do I Print W2 W3 1099 And 1096s

Sage 100 Consultant How To Print W2s And 1099s And How Do I Print W2 W3 1099 And 1096s

Confused While Printing And E Filing Your 1099 Misc With Quickbooks In 2020 Quickbooks Solutions Print

Confused While Printing And E Filing Your 1099 Misc With Quickbooks In 2020 Quickbooks Solutions Print

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

Transition From An Employee To 1099 Contractor Process Printing Business Cards Employer Identification Number Irs Forms

Transition From An Employee To 1099 Contractor Process Printing Business Cards Employer Identification Number Irs Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

2013 W2 Form Retirement Tax Forms Available Still Waiting On 1099 Tax Form Tax Forms W2 Forms

2013 W2 Form Retirement Tax Forms Available Still Waiting On 1099 Tax Form Tax Forms W2 Forms

Downloadable 1099 Misc Form 1099 Misc Recipient Copy B 1099 Tax Form Letter Template Word Tax Forms

Downloadable 1099 Misc Form 1099 Misc Recipient Copy B 1099 Tax Form Letter Template Word Tax Forms

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

Using The 1099 Wizard To Create 1099s

Using The 1099 Wizard To Create 1099s

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Small Gift Cards Printing Services Print Service Magzine Printing Print Flyers Booklet Printing Label Printing Print Business Cards Flyer Printing Cust Printing Business Cards Flyer Printing Booklet Printing

Small Gift Cards Printing Services Print Service Magzine Printing Print Flyers Booklet Printing Label Printing Print Business Cards Flyer Printing Cust Printing Business Cards Flyer Printing Booklet Printing

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile