How Is An Llc Taxed In New York

In addition foreign LLCs and LLPs that wish to carry on or 4. You can register your New York LLC for all of your business taxes through the New York Business Express Portal.

Forget The Package Delivering Drones Online Retailers Are Really Focused On Taxes This Holiday Season Corporate Law Sales Tax Tax

Forget The Package Delivering Drones Online Retailers Are Really Focused On Taxes This Holiday Season Corporate Law Sales Tax Tax

A corporation may also be taxed based on its business and investment capital minus liabilities.

How is an llc taxed in new york. Annual Fee There is an Annual Filing Fee for each LLC formed in New York which varies depending upon your LLCs income. In New York individual LLC members must pay state income tax on the amount distributed to them but the LLC itself must also pay the state filing fee. New York Annual Fee.

Federal tax regulations allow an LLC to elect its tax status for income tax purposes. Andersen Tax LLC New York NY. New Yorks tax structure for LLC businesses is lowthe AFF tax scale starts at 25 minimum and caps at 4500.

The corporation will have to pay a tax on profits. February 27 2021 Full-Time At Andersen Tax LLC Andersen we offer a rewarding career path for exceptional motivated and entrepreneurial individuals. This fee ranges from 25-4500 and is based on New York Adjusted Gross Income.

4 rows Minimum Taxable Income. Top State for Small Businesses According to reports in 2016 998 of. Both domestic LLCs and LLPs are required to register with the New York State Department of State.

If you elect for your LLC to be taxed as a C corporation youll file the Form 1120 corporation tax return. Both LLCs and LLPs are treated as partnerships in regard to taxation at both the federal level and for New York state taxes. They both have the option to be taxed as an s corporation if they make the election after forming.

An LLC elects to be taxed as a C-Corporation via IRS Form 8832 and an LLC elects to be taxed as an S-Corporation via IRS Form 2553. New York City does not recognize S corporation status. It applies to all the earnings you withdraw from your New York business.

A single-member LLC SMLLC that is treated as a disregarded entity for federal income tax purposes will be. The tax rate applied to this amount is 015 with a cap of 1 million in taxes. For income tax purposes state law follows federal law.

An LLC or LLP that is treated as a corporation including an S corporation for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made or if it is a mandated New York S corporation. For income tax purposes state law follows federal law. LLC as a C Corporation.

All New York LLC business members or managers who take profits out of the LLC will need to pay self-employment tax. Also depending on the nature of the business the limited liability company undertakes the LLC may have to pay or collect sales taxes employee withholding taxes and other taxes. Federal tax regulations allow an LLC to elect to be taxed as a corporation or partnership for income tax purposes.

The formation of a domestic LLC is governed by the New York Limited Liability Company Law. For income tax purposes New York State law follows federal law. For federal taxes both will be treated the same as an s corporation and as a c corporation for New York state taxes.

From the moment your employment begins you will be exposed to a variety of projects giving you the opportunity to stand out and make a difference. However youll most certainly want to speak with an accountant or a few since these types of taxation are usually only best once your business is earning a certain amount of net income. Additionally New York state law and certain other states laws imposes a tax based on the number of members of the LLC.

Traditional LLCs are not required to pay the states complicated corporate franchise tax. A Delaware LLC with income gain loss or deduction from New York State sources will also be required to file Form IT-204LL and pay an annual LLC filing fee. Additionally state law imposes.

A one-member LLC is treated as a disregarded entity. A New York C-corps MTI is equal to the entitys income that is. Consequently a New York S corporation having income form New York City sources will be taxed as a corporation for New York City tax purposes and has to pay New York Citys General Corporation Tax.

The formation of a domestic LLP is governed by Article 8-B of the New York Partnership Law. Does an LLC pay Taxes. How is a Limited Liability Company Taxed.

Members will report any of this income that is passed on to them on their individual tax returns as dividends or interest and once again pay taxes on it. Consult a tax adviser about these check-the-box regulations and any changes. Additionally state law imposes a tax based on the number of members of the LLC.

Consult a tax adviser about these regulations and any changes. This tax is also known as FICA Social Security or Medicare tax.

Pros And Cons Of Running An Llc In New York Legalzoom Com

Pros And Cons Of Running An Llc In New York Legalzoom Com

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Tax Returns Day Ii Bulltaxaccountants Tax Accountant Tax How To Plan

Tax Returns Day Ii Bulltaxaccountants Tax Accountant Tax How To Plan

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

The Act Allows Flow Through Businesses In New Jersey Such As Sub S Corporations Partnerships Llcs Or Sole Proprietors Tax Deductions Income Tax Tax Services

The Act Allows Flow Through Businesses In New Jersey Such As Sub S Corporations Partnerships Llcs Or Sole Proprietors Tax Deductions Income Tax Tax Services

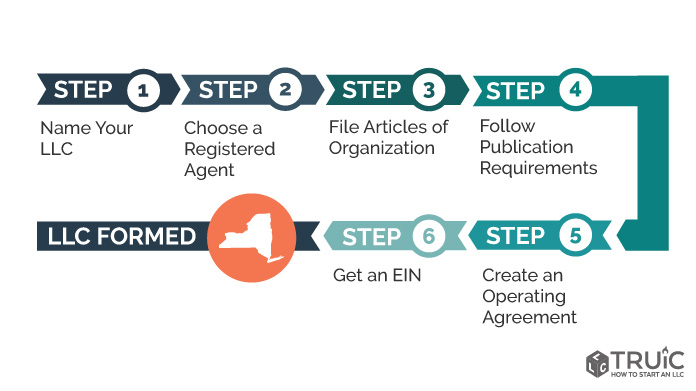

![]() Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Ny Llc Operating Agreement Llc Business Writing A Business Plan Llc

Ny Llc Operating Agreement Llc Business Writing A Business Plan Llc

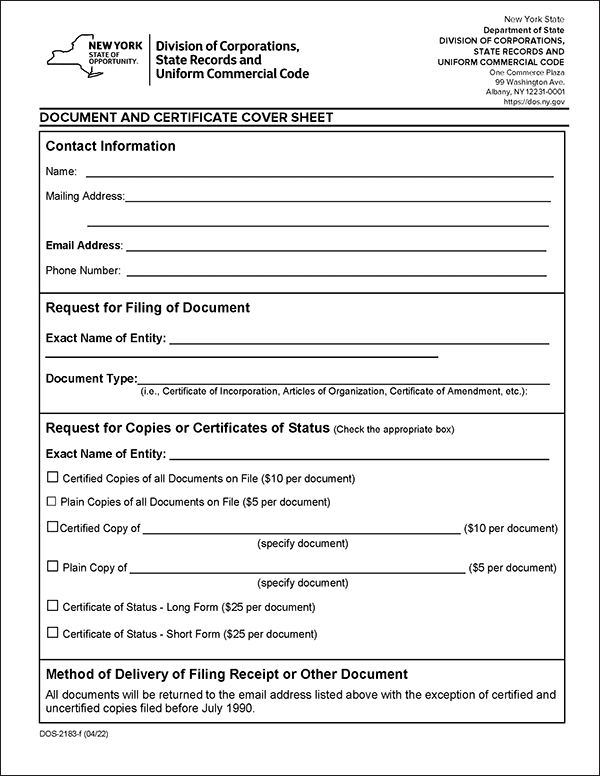

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

Screenshot New York Business Express Business New York Expressions

Screenshot New York Business Express Business New York Expressions

First Day Of Filing Taxes Is January 20 Please Call Our Office 7183320000 Great Customer Care And Reasonable Prices Tax Accountant Filing Taxes Tax

First Day Of Filing Taxes Is January 20 Please Call Our Office 7183320000 Great Customer Care And Reasonable Prices Tax Accountant Filing Taxes Tax

Business Accounting Tax Preparation Tax Preparation Income Tax Preparation Business Account

Business Accounting Tax Preparation Tax Preparation Income Tax Preparation Business Account

Masa New York Google Search Nyc Restaurants Sports Travel How To Apply

Masa New York Google Search Nyc Restaurants Sports Travel How To Apply

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

Income Tax Form For Llc Five Facts That Nobody Told You About Income Tax Form For Llc Tax Forms Income Tax Told You So

Income Tax Form For Llc Five Facts That Nobody Told You About Income Tax Form For Llc Tax Forms Income Tax Told You So

Choosing The Right One For Your Company Depends On Your Particular Business Operational Needs And Tax Strategy Tax Accountant Tax Accounting

Choosing The Right One For Your Company Depends On Your Particular Business Operational Needs And Tax Strategy Tax Accountant Tax Accounting

Call Our Office To Schedule Your Appointment 718 332 0000 Bulltaxaccountants Tax Accountant Accounting Free Plan

Call Our Office To Schedule Your Appointment 718 332 0000 Bulltaxaccountants Tax Accountant Accounting Free Plan

What Is An Llc And What Are The Benefits Llc Taxes Llc Ways To Save

What Is An Llc And What Are The Benefits Llc Taxes Llc Ways To Save

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York