How To Apply For A Small Business License In Indiana

In the state of Indiana not all entities are required to have a general business license. The requirements vary depending on the city or county involved.

You can contact the Right of Way Office by calling 260 427-6155.

How to apply for a small business license in indiana. For these you must deliver your application in person to the Department of Business and Neighborhood Services BNS office no later than 230. Indiana does not have any one single comprehensive business license. Select a Business Entity.

Please refer to the Online Business Tax Application BT-1 Checklist for more information. Obtain Permits and Licenses for Your Indiana Business. Choose a Business Idea.

Create an online account in our secure My DOR system. You usually will need to submit your business name address purpose and a listing of prior companies you had in the locality. When applying for a local license what is required depends on the structure and sector of your company.

The business license may be required from just one government level such as the state or any two or all levels of government may require you to get a permit or license. You can find more details by checking the website for the city and county where youll operate your business. If you have city or state endorsements it may take an additional 2-3 weeks to receive your business license due to approval time.

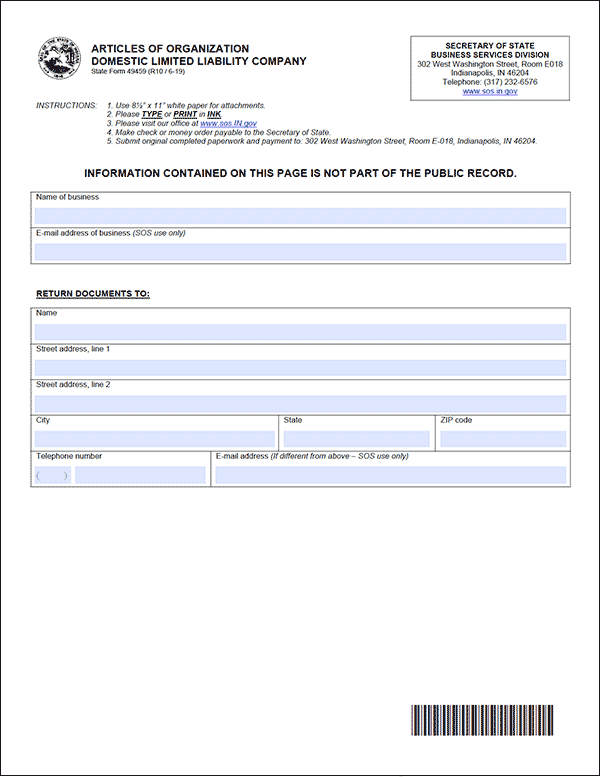

This account will also be used to file your taxes and make changes to your business. From registering your businesss name to filing required paperwork you need go no further than INBiz. Register with the Department through INBiz Use Indianas one-stop resource for registering and managing your business.

Apply online applications will take approximately 10 business days to process. The cost of the event itself will be determined by the City of Fort Wayne for they will have to supply officers barricades etc. If you are starting a new business in Indiana you may need to register with the Indiana Department of Revenue.

Business Tax Application. Apply for Business Licenses Permits. Selecting a business name is one of the first steps of starting a business.

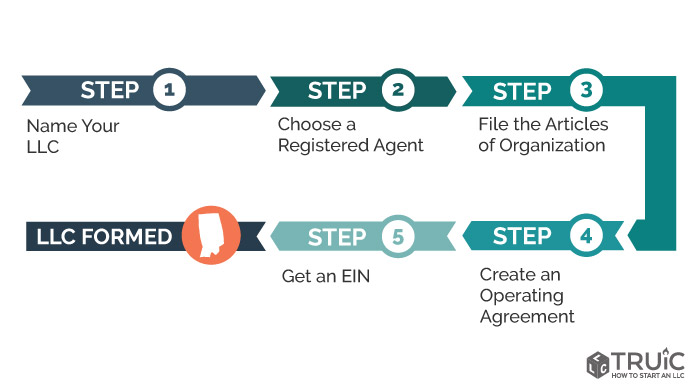

All corporations limited partnerships limited liability partnerships and limited liability companies must file organizational documents with. Starting a Business in Indiana Simple Step-by-Step Guide. By mail complete the Business License Application along with.

Register a Business Name. In order to keep a regular check on sale and the purchase transactions and tax amounts state governments have made this license mandatory for every business. In partnering with the Secretary of State Department of Workforce Development and the Department of Revenue INBiz has created a best-in-class portal that provides a streamlined and expedited process for your business needs.

Most small businesses need a combination of licenses and permits from both federal and state agencies. What costs will those who apply for any business permits in Fort Wayne Indiana need to pay. The application can be found online.

For example the City of Indianapolis and Marion County each have licensing rules that can apply to small businesses. Indiana law requires that the name of a Corporation LLC LP and an LLP. Businesses that are starting expanding hiring employees for the first time changing ownership or organizational structure or moving into Indiana.

Several of the following licenses require fingerprint background checks. Apply for licenses and permits. Open a Business Bank Account.

Register business name the first and foremost step is registering your small business under a fictitious name. Many industries however need industry-specific permits or licenses to maintain compliance. A Crawfordsville Indiana Business License can only be obtained through an authorized government agency.

8500 Keystone Crossing Suite 400. DECIDING ON A BUSINESS NAME. Is distinguishable from the name of any other business of the same type on.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Crawfordsville Indiana Business License. In addition to start your own Clothing business the first step is to apply for a IN Home Occupation Business License Johnson County Occupational Business License Bargersville Business Permits IN Counties Business Tax Registration Sitemap but IN Incorporation is at state level registration. Link is external Phone.

The requirements and fees vary based on your business activities location and government rules. Most businesses operating in the state that are selling a product or offering certain services will need to register for a Registered Retail Merchant Certificate also referred to as a sales tax permit by filing the Business Tax Application BT-1 with the Indiana Department of Revenue. Write a Business Plan.

References will also be needed and the property needs a zoning inspection. On this page youll find general instructions for business license applications followed by licensing requirements for businesses by type. State Business license Tax collection is the purpose of every state.

However all businesses operating in Indiana are subject to regulatory requirements that may involve several state agencies. Application instructions and licenses by type. Businesses operating in Indiana do not need to apply for a state business license but they do need to register with the state.