Should Llc Get 1099

We have a 1099-MISC issued to the LLC and using the EIN. Royalty payments tax-exempt interest or substitute dividends that are larger than 10.

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099.

Should llc get 1099. When an LLC Must Provide Form 1099-MISC. They dont have to report payments that were made for personal reasons. Your LLP must also.

And a great way to prove youre contracting work is a business is by forming an LLC. The IRS provides five different situations where an LLC must provide someone with Form 1099-MISC. If a Subchapter S or LLC electing S status then the owner is on payroll and gets a W2.

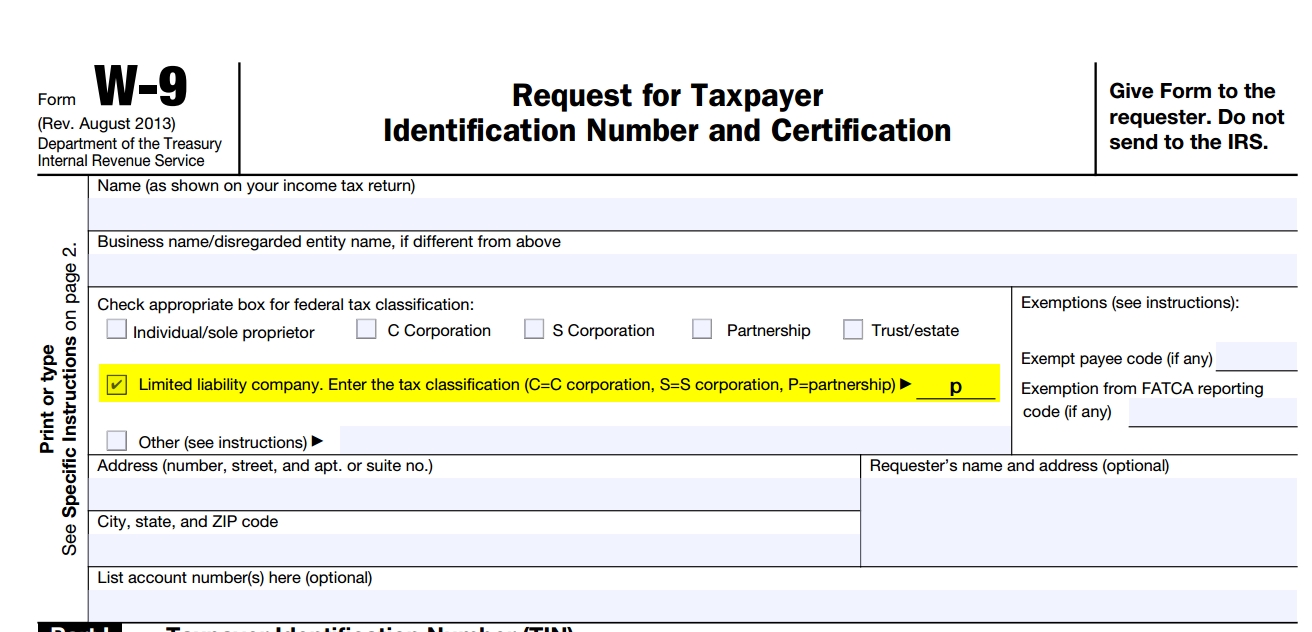

Just look at the W-9 the worker provided. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

Legally I dont know the answer. Form 1099-MISC although they may be taxable to the recipient. It makes no difference for tax purposes.

If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. If the person has a single member LLC and is taxed as a corporation then you do not have to issue the LLC a 1099 MISC. If their LLC is taxed as an S- or a C-Corp you do not unless an exception applies as described above.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. However if your independent contractor has their business established as a corporation either an S Corp or a C Corp then for tax purposes they would be considered as such and would not typically be filing Form 1099s. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

When payments to independent contractors contract employees attorneys or accountants are 600 or more. Even though an LLC can file an election with the IRS to be taxed like a corporation your business may not be aware of the LLCs current tax status so its usually safer to issue a 1099 to any LLC that you pay more than 600 on an annual basis. Otherwise they or their clients could get into trouble.

In addition to that your taxes wont become much more complicated and youll enjoy the limited liability of any other LLC or corporation. However see Reportable payments to corporations later. How do we file the business and our personal taxes.

We have a 2 member LLC treated as a partnership for Tax purposes. Sole proprietor Do send 1099-MISC. But not an LLC thats treated as an S-Corporation or C-Corporation.

If the W-9 indicates they are an LLC that is taxed as a sole proprietorship you need to send a 1099. An easy way to tell. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

If the LLC files as a corporation then no 1099 is required or you dont need to send 1099 to the LLC. You do need to issue the LLC a 1099 MISC. A LLC member that loans money to the company as a true loan might get a 1099 INT but that is about it.

Businesses that file on form 1040 Schedule C ie. When your total rent payments require a 1099-MISC you will first need to. 1099 contractors need to treat their service as a business.

Sole proprietorsself employed Single member LLCs as they are considered disregarded entities DREs and also file on Sch C. Business owners only have to report payments for services or rent that were earned for business purposes. Payments for which a Form 1099-MISC is not required include all of the following.

Do LLC Companies You Pay Rent to Need to Get 1099 Forms. If the LLC has multiple members and is not taxed as a corporation the LLC is taxed as a partnership. A Limited Liability Company LLC is an entity created by state statute.

In addition to individuals you must also send a 1099 to the following if you paid them for doing work. Filing a 1099-MISC applies only to the rent you pay for business property not your personal. On the other hand for all contractors who are set up as LLCs but not filing as corporations taxed as a partnership or single-member LLC your business will need to file 1099 forms for them.

We pay ourselves a salary from the LLC and are issued w-2s. Heres another way to remember. At worst if a partnership the K-1 will indicate change in equity or guaranteed payments.

If you are 1099 you will pay the same amount of taxes as if you formed a corporation and then paid yourself essentially you are doing this as a 1099 contractor just not formally. If youre unsure its always best to file a 1099-NEC. Therefore your limited liability partnership must file and send 1099s for all applicable service providers who meet the 600 limit.

How To File Your 1099 The Creative Law Shop Entrepreneur Advice Creative Business Owner Creative Entrepreneurs

How To File Your 1099 The Creative Law Shop Entrepreneur Advice Creative Business Owner Creative Entrepreneurs

Do Llcs Get A 1099 During Tax Time Incfile

201 Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Yo Llc Taxes Financial Literacy Budgeting Finances

201 Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Yo Llc Taxes Financial Literacy Budgeting Finances

Llc Vs S Corp A Step By Step Guide For Choosing The Best Small Business Entity Careful Cents Budgeting Finances Business Budgeting

Llc Vs S Corp A Step By Step Guide For Choosing The Best Small Business Entity Careful Cents Budgeting Finances Business Budgeting

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

How To Create Your Blog Privacy Statement Jade Oak Sole Proprietor Blog Blog Tips

How To Create Your Blog Privacy Statement Jade Oak Sole Proprietor Blog Blog Tips

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

Get To Know How To Set Up An Llc Start Your Successful Business In The Us Http Blog Invoiceber Small Business Organization Llc Business Business Checklist

Get To Know How To Set Up An Llc Start Your Successful Business In The Us Http Blog Invoiceber Small Business Organization Llc Business Business Checklist

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

So Many Creative Entrepreneurs Are Often Confused When It Comes To The 1099 Or W 9 I Will Show You Wh Bookkeeping Software Business Blog Woman Business Owner

So Many Creative Entrepreneurs Are Often Confused When It Comes To The 1099 Or W 9 I Will Show You Wh Bookkeeping Software Business Blog Woman Business Owner

Businesses Must Need An Agreement With The 1099 Employees 1099 Employee Works On A Contract Basis The Payer Internal Revenue Service Employee Jokes For Kids

Businesses Must Need An Agreement With The 1099 Employees 1099 Employee Works On A Contract Basis The Payer Internal Revenue Service Employee Jokes For Kids