Business Forms That Provide Evidence Of Each Transaction

Recorded in appropriate accounts. 19 rows A form describing the goods or services sold the quantity and the price.

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

A source document describes all the basic facts of the transaction such as the amount of the transaction to whom the transaction was made the purpose of the transaction and the transaction date.

Business forms that provide evidence of each transaction. These carry the evidence of transactions. If you received a Form 1099-B for a transaction the Applicable checkbox on Form 8949 box near the top of that form may help you determine which box to check on the Part II. The transactions must be properly saved in order to determine the correct business outcome.

Every event is self-sufficient and independent of each other. Transactions are entered in the ledger accounts and then transferred to journals. Each transaction must be analyzed in terms of its effect on the accounts before it can be recorded in a journal.

The objective evidence accounting concept requires that there be proof that a transaction did occur True Examples of source documents include checks sales invoices receipts and memorandums. Each Party is given the right to get information from the other and its employees and each Party agrees to provide access to this information. One or more documentary evidence is shown in support of each transaction.

Banks do not accept exported transaction. Provide Forms 1099-MISC and 1099-NEC to each person to whom you have paid at least 600 for services including parts and materials during the calendar year in which you go out of business. This says that for a certain period of time the Parties will be the only ones negotiating with each other about the Proposed Transaction.

The actual specifics of business forms used by companies vary greatly. Documents provide a financial record of each event or activity and therefore ensure the accuracy and completeness of transactions. Select the account you would like a transaction history for.

Do not export the transactions. Under the double-entry system the two-sided effect of each transaction is. For Example Any business person.

File Form 1096 to file Forms 1099-MISC and 1099-NEC. These images support the recordation of cash receipts from customers. Source Documents Source documents are the business forms that document all financial transactions of a business from buying a chair to selling a pencil.

The equality of debits and credits provides the basis for the doubleentry accounting system. Proper documentation provides evidence of what has transpired as well as provides information for researching discrepancies. Some computer systems such as payroll systems also generate transactions that are recorded in one or more journals but without paper source documents.

Scroll to the bottom of the page and use the Refine Your Transaction History Search box to select the date range you require. The evidence of this transaction is machinery purchase and cash memo for purchase. Business forms include purchase orders receipts and invoices.

Business documents can provide evidence that a transaction has occurred. Login to Internet Banking. This can be used as evidence of cash sales which supports the recordation of a sale transaction.

All business transactions must be entered first in the general ledger. A machine worth 3000- is purchased for a business. This can be used as evidence for a disbursement of funds from petty cash.

Forms and papers that provide information about a business transaction are called ajournals. Transactions of goods or services in terms of money are called external transaction or business transaction. Source documents are business forms that provide evidence of each transaction and give the details that are entered later into one of the journals in a computer accounting system.

This describes the items shipped to a customer and so supports the recordation of a. Common source documents include. This system provides a logical method for recording transactions.

This includes expenses revenues inventories personnel and other types of transactions.

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

Affidavit Of Change Of Trustee California Change San Bernardino

Affidavit Of Change Of Trustee California Change San Bernardino

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

College Acceptance Letter Sample Check More At Https Nationalgriefawarenessday Com 25477 Colleg Engagement Letter College Acceptance Letter Acceptance Letter

College Acceptance Letter Sample Check More At Https Nationalgriefawarenessday Com 25477 Colleg Engagement Letter College Acceptance Letter Acceptance Letter

Accounting Source Documents Double Entry Bookkeeping In 2021 Accounting Education Bookkeeping Business Accounting Notes

Accounting Source Documents Double Entry Bookkeeping In 2021 Accounting Education Bookkeeping Business Accounting Notes

Application To Add New Officer To A Corporation California Conviction California State

Application To Add New Officer To A Corporation California Conviction California State

Hand Written Receipt Template Unique 36 Printable Receipt Forms Receipt Template Cover Letter Sample Good Essay

Hand Written Receipt Template Unique 36 Printable Receipt Forms Receipt Template Cover Letter Sample Good Essay

Credit Card Receipts Sample Credit Card Business Template Receipts

Credit Card Receipts Sample Credit Card Business Template Receipts

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

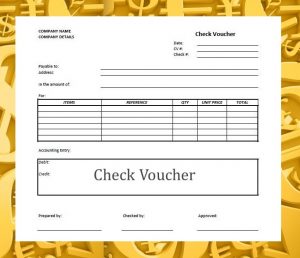

Cash Voucher Template Letter Template Word Word Template Voucher Template Free

Cash Voucher Template Letter Template Word Word Template Voucher Template Free

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

General Sales Receipt Business Form Microsoft Word Invoice Template Invoice Design Financial Plan Template

General Sales Receipt Business Form Microsoft Word Invoice Template Invoice Design Financial Plan Template

Sample Acknowledgement Receipt Template

Sample Acknowledgement Receipt Template

Complaint Form Alabama Form Complaints

Complaint Form Alabama Form Complaints

Payment Receipt Samples Payment Receipt Template Receipt

Payment Receipt Samples Payment Receipt Template Receipt

Assessment Form In Pdf Sample Assessment Self Assessment Business Template

Assessment Form In Pdf Sample Assessment Self Assessment Business Template

College Acceptance Letter Sample Check More At Https Nationalgriefawarenessday Com 25477 Colleg Engagement Letter College Acceptance Letter Acceptance Letter

College Acceptance Letter Sample Check More At Https Nationalgriefawarenessday Com 25477 Colleg Engagement Letter College Acceptance Letter Acceptance Letter

Forms Documents Needed For Proper Accounting Documentation Founder S Guide

Ms Word Self Assessment Form Template Word Document Templates Self Assessment Document Templates Word Template

Ms Word Self Assessment Form Template Word Document Templates Self Assessment Document Templates Word Template