How To Set Up Payment Plan With Irs Turbotax

It is up to you however to take that first step and make a request for the installment agreement which you can do by filing Form 9465. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person.

Turbotax Free Canada Android Apps On Google Play Turbotax App Filing Taxes

Turbotax Free Canada Android Apps On Google Play Turbotax App Filing Taxes

Payments can be made directly from your checking or savings account or by check money order or debitcredit card note that fees apply to payments.

How to set up payment plan with irs turbotax. Fees apply when paying by card. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. Make monthly payment by check money order or debitcredit card.

If you repay the benefits before Dec 31 st 2020 CRA will not issue an income slip and you will not have to report the benefit on your tax return. Select the installment payment plan option Continue and follow the onscreen instructions. Fees for IRS installment plans.

Your future tax obligations have to be paid in full and all of your required tax returns have to be. If you cannot meet the deadline and want to request a payment plan call the CRA COVID center at 1833-966-2099. Apply online by phone or in-person.

If you already filed or youre unable to find this option in TurboTax you can apply for a payment plan at the IRS Payment Plans and Installment Agreements. During the filing process TurboTax will have an option for applying for an installment agreement via Form 9465. IR-2019-13 February 13 2019 WASHINGTON The Internal Revenue Service today reminded taxpayers who may unexpectedly owe additional tax that there are many online options for payment as well as online options for applying for a payment plan for those who can not pay in full.

You also have the option when you file your return to apply some or all of your refund to your estimated tax payments for the coming tax. If you are willing to wait on hold then you should call into the IRS and they will work with you one on one to set up a payment arrangement that fits your needs. Pay online or by phone using the Electronic Federal Tax Payment System EFTPS Electronic Funds Withdrawal EFW only available during e-filing.

Terms and conditions may vary and are subject to change without notice. IRS approval allows you to pay the tax over 72 months and by filling out the request you agree to pay on time. If your request is approved you will receive a notice detailing the terms of your agreement and a request of 120 52 if you make payment by direct debit to set up the installment agreement.

Answer the questions and the form will be sent with your return you may be asked to make a first payment via check if you set up a direct deposit. If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. You can call customer support at the IRS using 800-829-1040.

Turbotax says my federal was accepted. 43 setup fee which may be reimbursed if. Same-day wire transfer from your bank.

Questions about payments and installment plans are among the top reasons taxpayers call or visit the IRS. But so far nothing. Short-term payment plan paying in 120 days or less If you need a few months to pay your tax bill off you can set up a short-term payment plan for a 0 setup fee.

If you need some time to pay the IRS has a few payment plan options available. If you are a qualified taxpayer or authorized representative Power of Attorney you can apply for a payment plan including installment agreement online to pay off your balance over time. Investors freelancers and beyond can save up to 22 on tax prep assistance.

My payment was supposed to be 45. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. If your balance due isnt more than 50000 you can apply online for a payment plan instead of filing Form 9465.

You can apply for a short-term payment plan if you can pay in full within 120 days by using the OPA application at IRSgovOPA or calling the IRS at 800-829-1040. OVERVIEW When you fall behind on your income tax payments the IRS may let you set up a payment plan called an installment agreement to get you back on track. Luckily Amazon has several TurboTax plans on sale as of April 13.

I logged into the IRS account and so. Once you call press 1 for English then wait for the recording to end. Apply by phone mail or in-person.

You can do this directly from the TurboTax program itself. Applying online for an installment agreement and other payment plans. Im in the same situation.

Terms and conditions may vary and are subject to change without notice. Terms and conditions may vary and are subject to change without notice. Once you complete your online application you will receive immediate notification of whether your payment plan has been approved.

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. If you havent filed yet step through the File section of TurboTax until you reach the screen How do you want to pay your federal taxes. IRS Direct Pay from your checking or savings account.

Were using cookies to improve your experience. Sudbury Tax Centre 1050 Notre Dame Avenue Sudbury ON P3A 0C3. Cash payment at a retail partner.

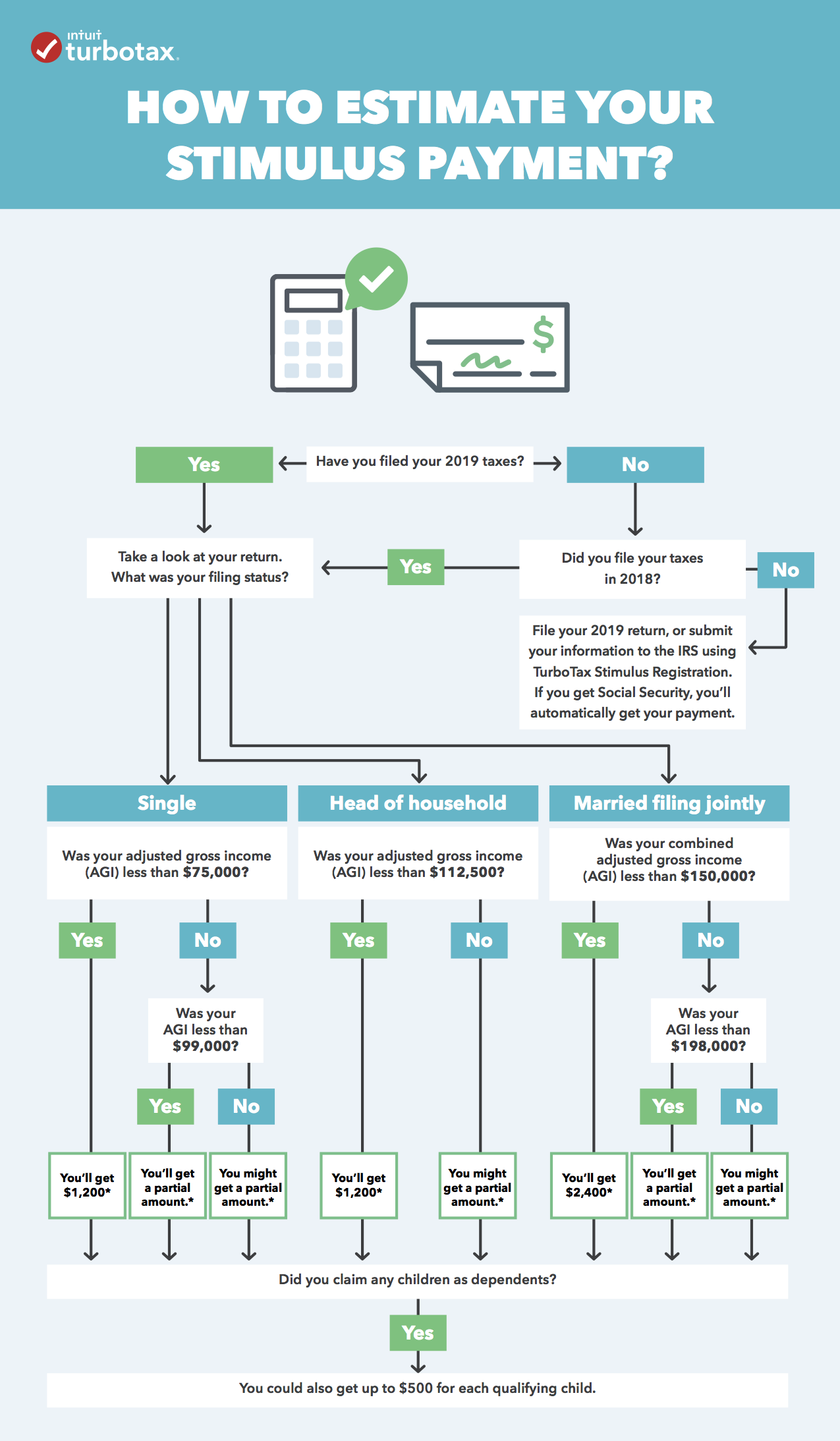

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

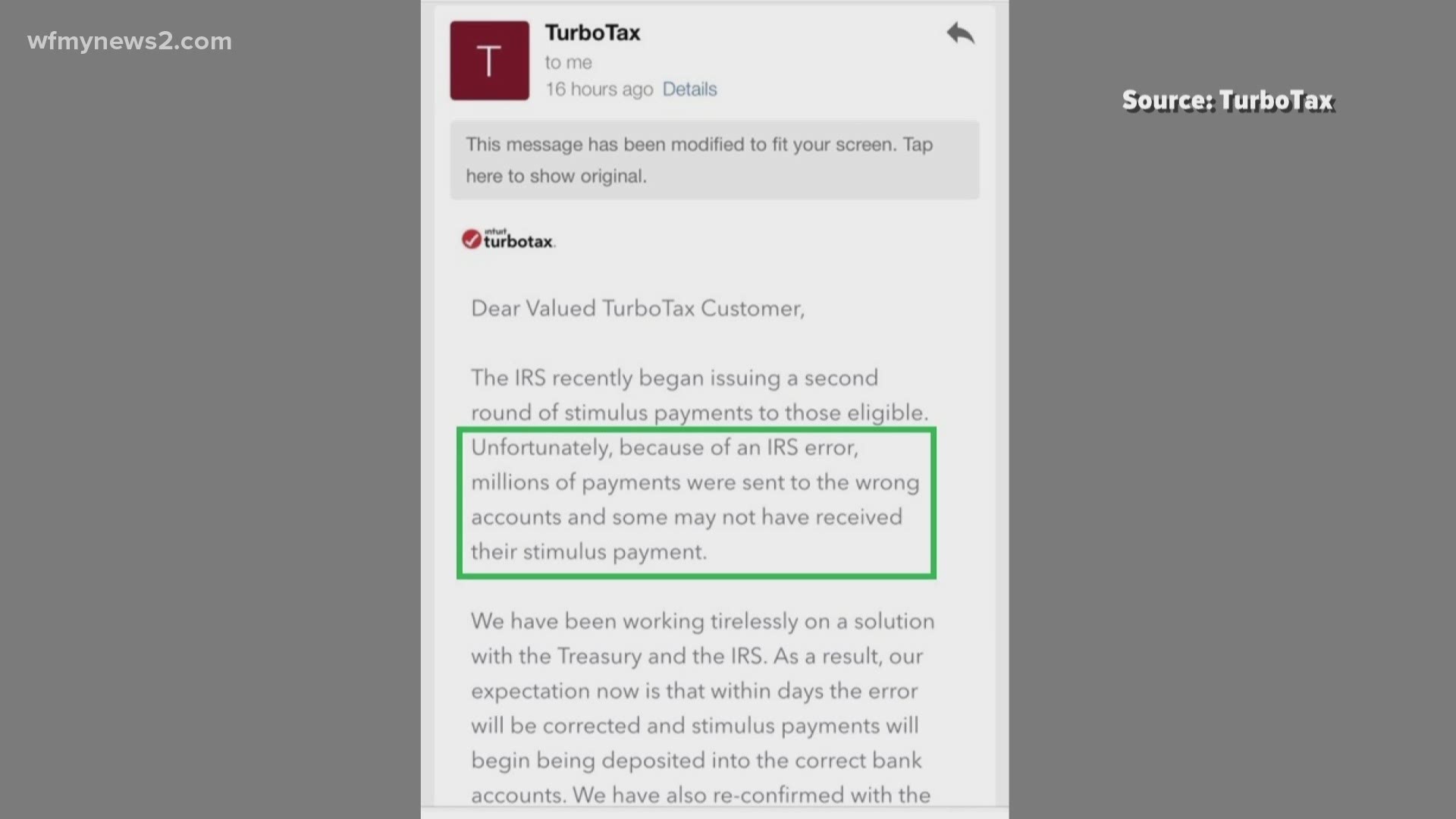

Turbo Tax And H R Block Customer Waiting On Stimulus Payment Wgrz Com

Turbo Tax And H R Block Customer Waiting On Stimulus Payment Wgrz Com

Irs Announces They Are Working On A New 1040 Tax Form Intuit Turbotax Has Got You Covered Tax Forms Turbotax Irs

Irs Announces They Are Working On A New 1040 Tax Form Intuit Turbotax Has Got You Covered Tax Forms Turbotax Irs

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

The Turbotax Scandal Provides A Key Lesson About Tax Preparers Turbotax Tax Preparation Tax Software

The Turbotax Scandal Provides A Key Lesson About Tax Preparers Turbotax Tax Preparation Tax Software

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

Irs Updates Free File Agreement Putting Turbotax On Notice Slashgear

Irs Updates Free File Agreement Putting Turbotax On Notice Slashgear

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Turbotax Review 2021 Nerdwallet

Turbotax Review 2021 Nerdwallet

Here S How Turbotax Just Tricked You Into Paying To File Your Taxes Propublica Turbotax Tax Software Free Tax Filing

Here S How Turbotax Just Tricked You Into Paying To File Your Taxes Propublica Turbotax Tax Software Free Tax Filing

Five Ways You Re Asking For An Irs Audit This Tax Season The Simple Dollar How Far Back Can The Irs Audit You Http Tax Guide Turbotax Tax Season

Five Ways You Re Asking For An Irs Audit This Tax Season The Simple Dollar How Far Back Can The Irs Audit You Http Tax Guide Turbotax Tax Season

Turbotax Launched A Free Online Portal To Help People Who Don T File Taxes Get Their Stimulus Check Faster Kimberly Wh Turbotax Free Tax Filing Filing Taxes

Turbotax Launched A Free Online Portal To Help People Who Don T File Taxes Get Their Stimulus Check Faster Kimberly Wh Turbotax Free Tax Filing Filing Taxes

How Do I Find Last Year S Agi Income Tax Return This Or That Questions Turbotax

How Do I Find Last Year S Agi Income Tax Return This Or That Questions Turbotax

Turbotax To Help Millions Of Americans Get Their Stimulus Payments With Launch Of Free Stimulus Registration Product The Turbotax Blog

Turbotax To Help Millions Of Americans Get Their Stimulus Payments With Launch Of Free Stimulus Registration Product The Turbotax Blog

What Is The Minimum Monthly Payment For An Irs Installment Plan Turbotax Tax Tips Amp Videos Irs Irs Payment Plan Tax Deductions List

What Is The Minimum Monthly Payment For An Irs Installment Plan Turbotax Tax Tips Amp Videos Irs Irs Payment Plan Tax Deductions List