How Do I Get My 1099 G In Georgia

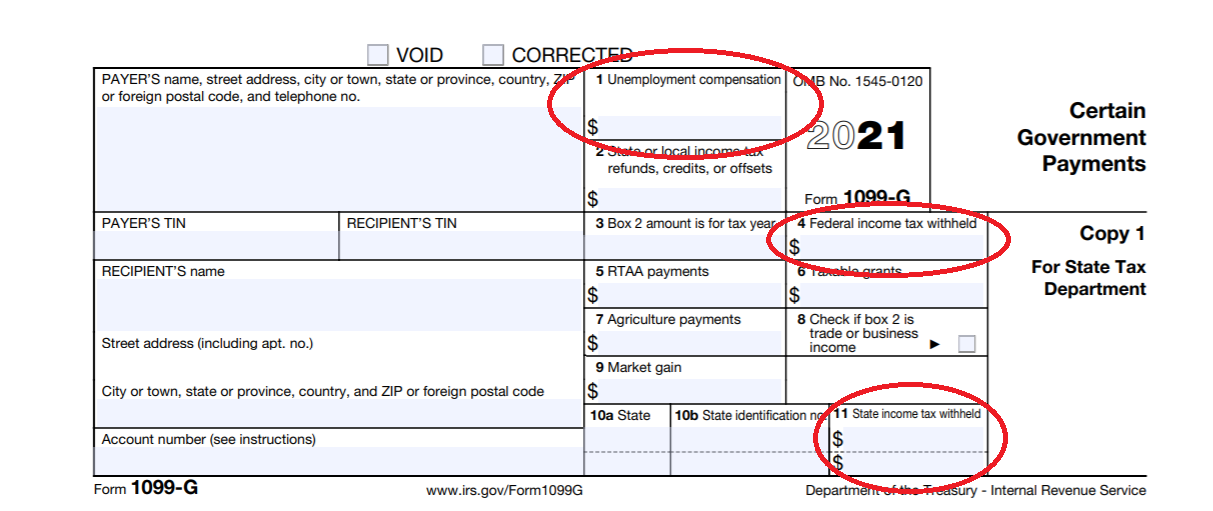

You are receiving the 1099-G because you itemized your deductions and received a refund credit or offset on your Georgia income tax return in 2015. The following documentation provides information on how to request a 1099-G electronically via the Georgia Tax Center.

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

To access this form please follow these instructions.

How do i get my 1099 g in georgia. It is the quickest and easiest way to receive your 1099-G To receive your 1099-G Electronically follow the guideline located at. You may need to include the amount shown in Box 2 below as income on your current years income tax return filed with the IRS. You may choose one of the two methods below to get your 1099-G tax form.

The state often times will not send out the 1099-G if they already know that you did not itemize on your Federal return. Go to the GTC website httpsgtcdorgagov. Taxpayers must log into their Georgia Tax Center account to view their 1099-INT under the Correspondence tab.

This system only provides a 1099-G if you received a New Jersey Income Tax refund and you itemized your federal return in the previous year. For information related to unemployment income please read FAQ 3. You will need the letter ID of the proposed assessment letter ID can also be found in GTC.

To receive your 1099-G Electronically follow the guideline located at. If you had an overpayment credit or offset of New York State income tax or the metropolitan commuter transportation mobility tax you may need to report it on your federal income tax return in the following year. Notify me when a return is filed with my SSN Protect yourself from fraud.

How to Request a 1099-G Electronically 1. Here at TaxBandits we support the e-filing of 1099s with Georgia. If you do not have an online account with NYSDOL you may call.

The 1099-INT statement is for non-incorporated businesses that were paid 600 or more in refund interest during the. Httpsdorgeorgiagovdocumentshow-request-1099-g-electronically-inst Or go to the Georgia Tax Center portal at httpsgtcdorgagov and click on the Receive 1099-G Electronically link. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. If you did itemize however and remember how much refund you received you can enter the information in the same area of TurboTax and select the option that states you did not receive a 1099-G to report the refund. You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN.

Receive your 1099-G Electronically Setup GTC to make your 1099-G available online. If you live outside of the United States please email us at 1099Gazdorgov to mail your form 1099-G. Protest a Proposed Assessment File a protest online.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. When filing state copies of forms 1099 with Georgia department of revenue the agency contact information is. After e-filing you need to take care of submitting Form G-1003 to the state.

Httpsdorgeorgiagovdocumentshow-request-1099-g-electronically-ins Or go to the Georgia Tax Center portal at httpsgtcdorgagov and click on the Receive 1099-G Electronically link. To find out if you need to report this information as income on a 2020 federal income tax return see the instructions for that return or contact the IRS or a tax preparer. For Businesses the 1099-INT statement will no longer be mailed.

How to Get Your 1099-G online. Create a FREE account at TaxBandits to e-file your 1099s. Form 1099-G call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700.

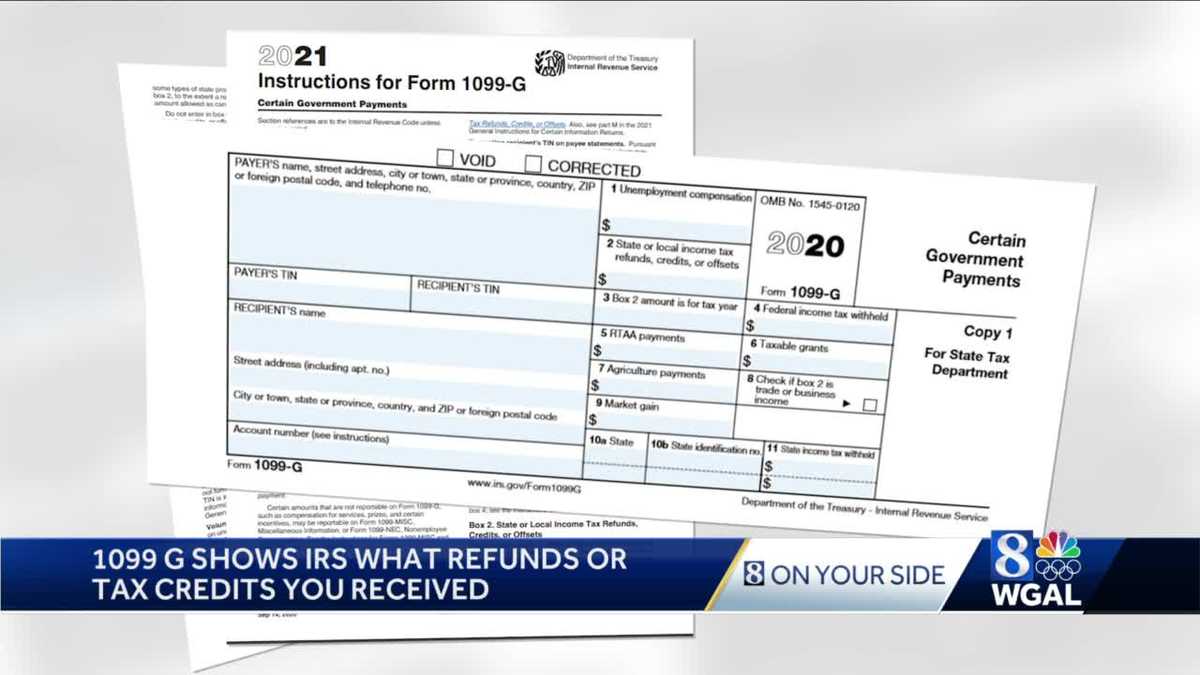

Under the Individuals section click the. Georgia Department of Revenue Processing Center. Form 1099-G reports the amount of income tax refunds including credits or offsets that we paid to you in a tax year if you itemized your federal deductions.

Local state and federal government websites often end in gov. Sign up for notifications. Before sharing sensitive or personal information make sure youre on an official state website.

GET FORM 1099-G. For additional information about Form 1099G see Frequently Asked Questions. A New York State Form 1099-G.

I received a Georgia State refund last year. If there is a problem with your PIN you can also access your form by selecting IRS Form 1099-G for UI Payments then enter other credentials. If you e-file 1099s you are required to submit only the G-1003.

The lookup service option is only available for taxpayers with United States addresses. Find the IRS Form 1099G for Unemployment Insurance Payments which is issued by the Georgia Department of Labor.

Alvin Diec Studio Inc Corporate Event Design Branding Design Restaurant Branding

Alvin Diec Studio Inc Corporate Event Design Branding Design Restaurant Branding

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Pin On Georgia 62 Free Tution Programs

Pin On Georgia 62 Free Tution Programs

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

Pin On Precepts Revelation Study

Pin On Precepts Revelation Study

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

1099 Int Software To Create Print And E File Form 1099 Int 1099 Tax Form Tax Forms Irs Forms

1099 Int Software To Create Print And E File Form 1099 Int 1099 Tax Form Tax Forms Irs Forms

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

Unemployment 1099 G Form Page 1 Line 17qq Com

Unemployment 1099 G Form Page 1 Line 17qq Com

2 Tax Forms That Landlords Shouldn T Miss In 2020 Being A Landlord Tax Forms Property Management

2 Tax Forms That Landlords Shouldn T Miss In 2020 Being A Landlord Tax Forms Property Management

Go Girl Undated Budget Planner Budget Planner Budget Book Budgeting

Go Girl Undated Budget Planner Budget Planner Budget Book Budgeting

A Pair Of Heads Grey Hound Dog Greyhound Whippet

A Pair Of Heads Grey Hound Dog Greyhound Whippet

How To Choose The Right Rug Size For Your Living Room 5 Formulas Guaranteed To Work Emily Henderson Living Room Rug Size Rug Size Rugs In Living Room

How To Choose The Right Rug Size For Your Living Room 5 Formulas Guaranteed To Work Emily Henderson Living Room Rug Size Rug Size Rugs In Living Room

Https Dor Georgia Gov Sites Dor Georgia Gov Files Related Files Document 2016 20g1003 Withholding Income Statement Transmittal Form G1003 20 281 29 Pdf

Ponto De Cruz Desenhos Graficos Cross Stitch Letters Cross Stitch Boards Stitch Cross Stitch Designs Cross Stitch Fonts Cross Stitch Alphabet Patterns

Ponto De Cruz Desenhos Graficos Cross Stitch Letters Cross Stitch Boards Stitch Cross Stitch Designs Cross Stitch Fonts Cross Stitch Alphabet Patterns

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work