How To File 1099 Forms Late

Use e-file provider to file 1099 Form. Filers must file the 1099-Misc Form before the due date with the IRS.

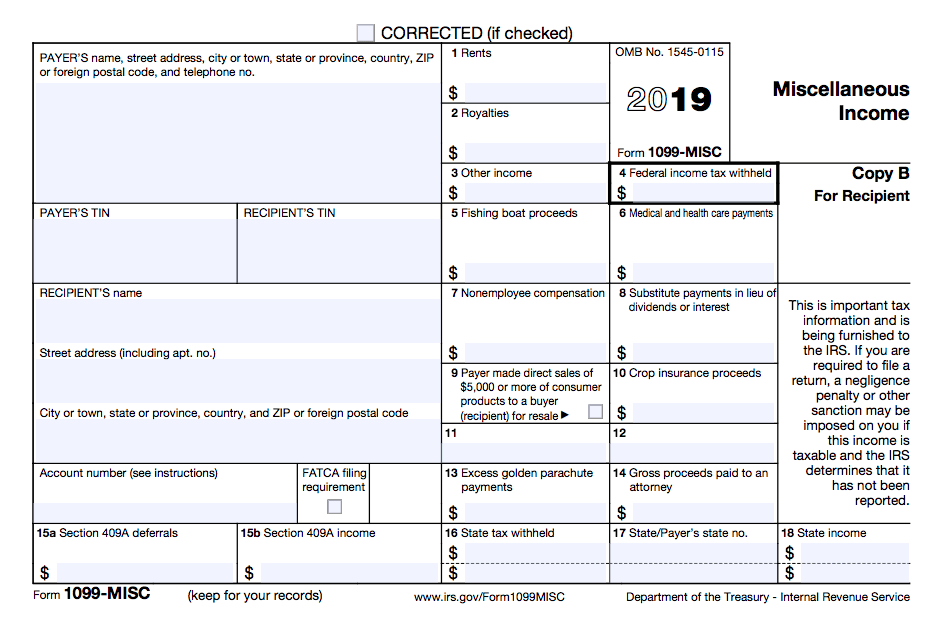

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

Also employers who are filing 250 forms and more than that should file them electronically until they are granted a waiver by the Internal Revenue Service.

How to file 1099 forms late. Transmit Form 1099-NEC Directly to the IRS. If the filer uses electronic filing then the filer must file the Form 1099-Misc to the IRS by March 31st 2021. Include transmittal Form 1096 when filing 1099 IRS Form through mail with the IRS.

Next you must submit your 1099-MISCs to the IRS. Unless the tax filer proves with a reasonable cause for missing or incorrect Form 1099 correction the tax filer would be fined for filing late failing to add the required information or paper filing the form where you need to e-file. The last date to file Form 1099 by the paper is the last day of February of the next tax year.

Oh no -- I missed the filing deadline. Get the lowest price in the industry when you e-file Form 1099-NEC for just 149 per form. Also if the filer uses paper filing then the filer must file the Form 1099- Misc Box 7.

The 1099 Late Filing Penalty. After reporting a late 1099 the IRS will attempt to contact the payer to determine why you have not received the form in question. Beginning with the 2020 tax year the Form 1099-MISC deadline is March 1 if you file on paper and March 31 if you file electronically.

Enter your Information Easily. It may be too late to file 1099 form 2018 on time but you can ensure an on-time 2020 or 2021 filing with the help of our software. The different penalty levels are determined by the size of your business and how long it takes you to correct the.

There will be no interest on the penalty if you pay the penalty by the date indicated in. Help Filing Your Past Due Return For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD. The penalty for late filing of forms 1099-MISC is 50 per form if late for 30 days or less and 100 per form if late more than 30 days.

Get the lowest price in the industry just 149 per form when you e-file Form 1099-MISC. If you are reporting payments made to your landlord for business rent during a tax year you must fill out Form 1099-MISC box 1. This increases to 270 per form if you file after August 1 if you dont file corrections or you dont file the forms.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. Assuming were talking about 2016 or 2017 tax years the 1099 late filing penalty is somewhere between 50-260 per return unless youre found to have shown intentional disregard in which case you may be assessed a penalty of 530 per return. You can download and print the form you need Copy B of 1099-MISC from the IRS website.

Follow these steps to meet your Form 1099-NEC deadline easily. Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks. The last date for filing Form 1099 electronically is March 31.

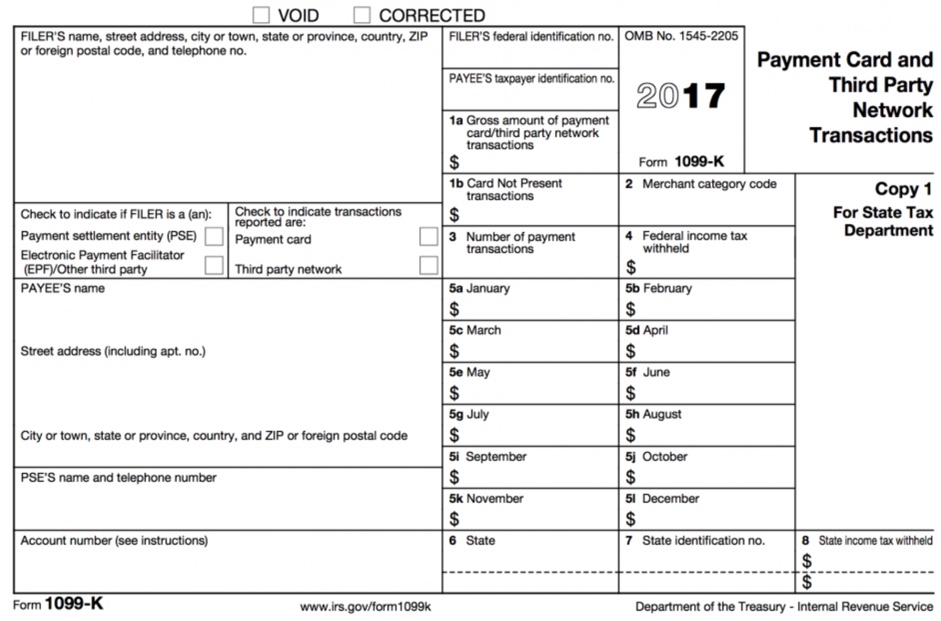

Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. Forms 1099 come in many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for. Complete your return in minutes and get your filing status instantly.

You can wait to receive a letter from the IRS to pay the penalty. You can report a late 1099 to the IRS directly by speaking with one of their representatives over the phone. Transmit Form 1099-MISC to the IRS.

The penalty is 50 per W-2 form or 1099-NEC form if you correctly file within 30 days of the due date for filings due after December 31 2019 including the January 31 2020 due date. Also you can postal mail the recipient copies with the postal mailing option. Its 110 per form if you correctly file more than 30 days after the due date but by August 1.

How Much is the 1099 Late Filing Penalty. Whenever Forms 1099 arrive dont ignore them. When you need to file a Form 1099 correction and failed to do so you will be subject to the same penalties similar to Form 1099 late filers.

Keep employee and contractor data within a single software for ease of filing then file directly from the program. E-file with the postal mailing option is available for 299form. You can also contact your employer or payer of income.

Also you can postal mail the recipient copies with the postal mailing option. This form is due by March 31st if you file electronically or February 28th if you file on paper. Forms 1099 Deadlines for Payment Providers.

However since January 31 2021 is a Sunday the 2020 tax year deadline is moved to Monday February 1 2021. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each. Meet your Form 1099-MISC deadline in just a few steps.

Enter your Information Easily. The first and foremost thing to consider is to file 1099 Tax Forms timely by following IRS guidelines. Beginning with tax year 2020 Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically.

Send the Copy B of IRS 1099 Tax Form to the payee within the deadline. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for Transcript of Tax Return and check the box on line 8. Youll need to either file online or order the forms you need Copy A of 1099-MISC and Form 1096.

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Get Ready For Your 1099 Misc Reporting Requirements Harper Company Cpa Plus

Get Ready For Your 1099 Misc Reporting Requirements Harper Company Cpa Plus

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

What Is A 1099 Misc Form Financial Strategy Center

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

All You Need To Know About The 1099 Form 2020 2021

All You Need To Know About The 1099 Form 2020 2021

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Form 1099 Penalties Late Filing Penalties For 1099 Forms

Form 1099 Penalties Late Filing Penalties For 1099 Forms

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

2020 Reviews Of W2 And 1099 Compliance Programs Cpa Practice Advisor

2020 Reviews Of W2 And 1099 Compliance Programs Cpa Practice Advisor

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

It S Time To File 1099s Avoid 50 100 Plus Late Penalties Per Form Opelika Observer

It S Time To File 1099s Avoid 50 100 Plus Late Penalties Per Form Opelika Observer